Is the US Dollar “Fed” Up?

The Fed is forced to balance a lot of competing forces when it meets today.

The Fed is forced to balance a lot of competing forces when it meets today. Tighter monetary policy is certainly warranted due to record high US inflation and buoyant US economy. The recent slide in equity markets and the rise in geopolitical tensions related to the Ukraine, however, combined with the backdrop of still ongoing concerns about COVID-19, doesn’t make its job easier.

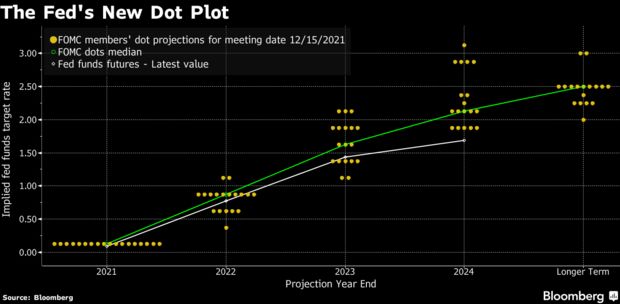

What do we expect from today’s meeting? In short, the Fed has already provided a lot of guidance on what it expects next in recent months. Broadly, speaking the consensus by economist and what has on average been priced in by markets is: 1) four 25 bps hikes in 2022 starting in March; 2) the end of asset purchases by mid-March; and 3) the start of balance sheet reduction from mid-year, most likely September.

Today’s meeting comes without projections, so it is down to what the Fed says both in its statement and press conference. For the Fed to be marginally more hawkish, the only probable path would for them to announce the immediate end to asset purchases, which would open the door for earlier balance sheet reduction.

That outcome seems more sensible than the Fed raising rates today, Fed giving indications of a 50bps hike at the end of each quarter, or raising interest rates at interim meetings, albeit all options are still on the table.

In terms of the size of balance sheet reduction, anything hinting at over $75-100bn a month would also likely be interpreted as hawkish by the market.

DXY Daily Chart

Now back to the original question, is the US dollar Fed up? Possibly, but the basically technical setup of the DXY is far from bearish. The index is trading well enough above the 200-day exponential moving average, has recently bounced off the 61.8% Fibonacci retracement from its move up from its October low and November high and the daily RSI is above 50.

DXY vs US Dollar Positioning

Likewise, although it is true US dollar positioning is somewhat stretch and some of the recent DXY boost is related to Ukraine and its status as a safe-haven, there is still capacity in the market to add further dollars in net-long. In summary, trading the DXY ahead of the Fed meeting is risky business. Better to see how things play out post the meeting. If price tests and fails the 96.92-96.40 region, that may be a better indication that the DXY is truly fed up with the direction of US monetary policy.

Latest News

-

VARIANSE Launches Crypto CFDs

Jan 13, 2023, 3:30 PM

-

An Automated Trading Partnership: ClickAlgo and VARIANSE

Nov 16, 2022, 10:53 AM

-

VARIANSE Is Best Broker for Online Trading UK

Sep 15, 2022, 4:18 PM

-

ECB leaves EUR/USD traders disappointed

Jun 9, 2022, 4:26 PM

-

AUD/USD: keep your eyes peeled on 0.72664

Jun 1, 2022, 11:40 AM