US Data to Take Centre Stage

Expected the unexpected when it comes to the US dollar.

A sparsity of US data and Fed speakers last week didn’t stop the US dollar index (DXY) from posting gains against the backdrop of rising US yields. Prior indications that the Fed would look to unwind its balance sheet and hike rates more aggressively clearly proved more compelling than events elsewhere.

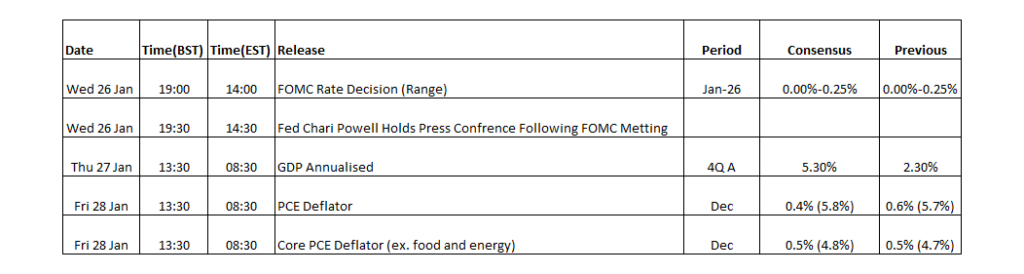

That said, as we turn to this week, which is US tier-1 data heavy, it’s hard to fathom what could shift rate expectations higher. Markets are already pricing four quarter point hikes from the Fed in 2022. Likewise, balance sheet reduction and accelerated pace of tightening are now priced to a degree. Wednesday’s Fed meeting won’t lead to an interest rate hike, as the Fed has signalled no hikes until March at the earliest.

What matters more on Wednesday is how hawkish or dovish the Fed sounds and any details around future balance sheet reduction. The Fed, however, will also need to do some damage assessment of the recent correction in equity markets, the move higher market yields, and the headwinds to passing even parts of President Biden’s Build Back Better plan into its outlook.

The Q4 2022 GDP print Thursday is expected to show the US economy expanded by 5.4% on an annualized basis vs 2.3% previously. Should that, along with the December PCE print, the Fed’s preferred measure of inflation, surprise substantially to the upside, that might lend support the US dollar. But anything equal or less, even if it be down to exceptional circumstances related to Omicron, may easily weigh on the Greenback.

Furthermore, on more technical grounds there is an argument to say that net-speculative US long positioning in the market looks more over stretched than not, especially against the Japanese yen (JPY) and Australian dollar (AUD). In addition, last week’s gains in the broad US dollar were not so convincing to strongly wager on a big break to the upside in a similar direction and the short end of the bond market looks at least temporarily oversold.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM