The FTSE China A50: Gain From China Exposure

- The FTSE China A50 gives you exposure to China’s largest listed A Share companies

- China A Shares have advantages over other types of Chinese equities

- The VARIANSE FTSE China A50 CFD allows you to trade micro lots

China Offers Traders Unique Opportunities

China offers huge potential for traders. When measured in purchasing power terms, the country is the largest in the world and in nominal terms only second to the US in terms of size. Mainland China is also home to two of the top ten largest equity exchanges globally. A minute doesn’t go by when China and the Chinese economy aren’t in the news, providing suitable volatility for traders to profit. Yet for investors and traders from the West, China can still feel very foreign. Capital controls in China made physical speculation on mainland listed A shares very difficult if not impossible for the average individual trader. The FTSE China A50 Index, however, gets around many of these hurdles allowing traders to gain exposure to the China A Shares market.

The Biggest in China

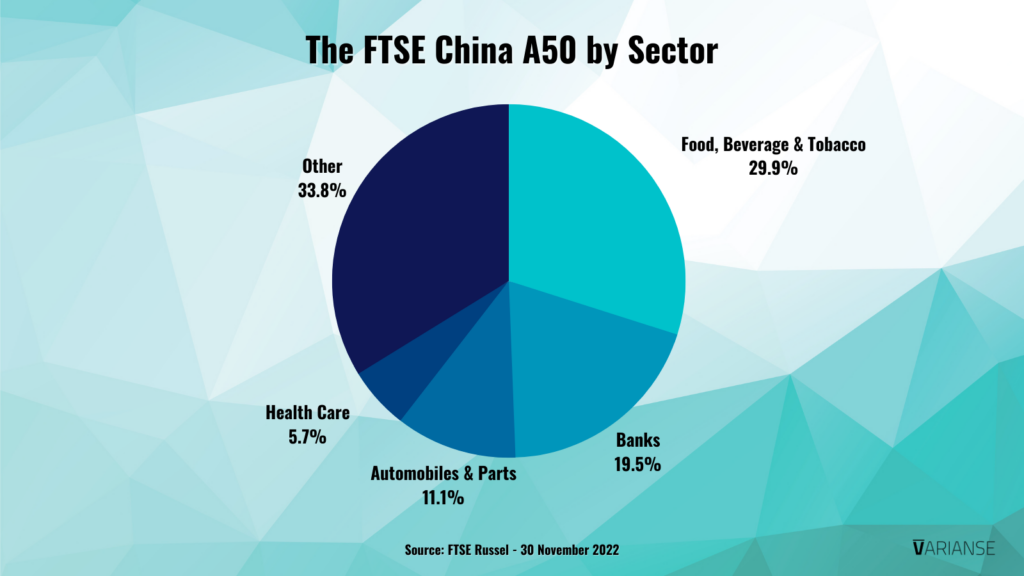

Representing the 50 largest listed A Share companies by market capitalization on the Shanghai and Shenzhen exchanges, the FTSE China A50 is truly one of the most liquid of China’s main indices. Speculators, cash investors, and even those looking to hedge their share exposure to China flock to the FTSE China A50 for its liquidity and diversity. Likewise, it is the de-jure index used by CFD traders to speculate on China A shares. When priced directly in US dollars, the FTSE China A50, also avoids the hassle of dealing with cumbersome translations from CNH to USD. I personally trade the FTSE China A50 when I am looking to capitalize on broad shifts in risk sentiment within China on a day and swing trade basis.

Gain Access to China A Shares

One of the most attractive features of the FTSE China A50 is that it allows exposure to Mainland A Shares. China has complex capital controls restricting foreign access and ownership in domestic shares. Plenty of resources on share ownership restrictions and investment restrictions in China exist. Here is a list of some of the articles, which I personally found useful when I was doing my own research on the topic:

- Foriegn Institutional Investment in China

- China’s Stock Markets – An Introductory Guide

- 5 Things to Know About the QIF Scheme

Although restrictions are gradually being relaxed over time, A Shares, denominated in CNY, are primarily only available for purchase by mainland citizens. B shares, on the other hand, are quoted in foreign currency, and therefore available to foreign investors, but don’t attract that much interest from domestic investors due to foreign currency restrictions. Chinese companies can choose to list in both, but B Shares typically trade at a discount to their A-Share counterparts. H-shares are yet another common type of Chinese share, which are shares listed in Hong Kong and are open to investment by anyone.

The Benefits of China A Shares

That the FTSE China A50 allows access to mainland A Shares is a major benefit to traders for several reasons. First, by largely being restricted to domestic investors, A Shares provide a better proxy for true risk appetite within China than the other types of shares available. Second, according to a recent report from investment bank UBS, 86% of China domestic stock investors in 2018 were retail, meaning they tend to also be more volatile than other developed markets. Last, but not least, because of their heavy domestic investor base, China A Shares tend to be less correlated with other asset classes, making them ideal for scalping, day trading, and swing trading.

VARIANSE Offers A50 Mini Lots

Gaining exposure to the FTSE China A50 Index through CFDs offered by VARIANSE has even more added benefits. Prime amongst them is the ability to trade the FTSE China A50 Index in micro lot contract sizes. Typically, with indices like the FTSE China A50 Index, the standard CFD contract size is 1 USD per index point. For example, if the index were trading at 13,000, the standard notional value size would be USD 13,000 or a dollar per individual point. With the VARIANSE FTSE China A50 Index, however, the minimum contract size is 0.01 or a single cent per point with a notional value of USD 130 if, as previously mentioned, the market were trading at 13,000 points. That means with just a minimal amount of capital, you can start trading China indices with VARIANSE from day one.