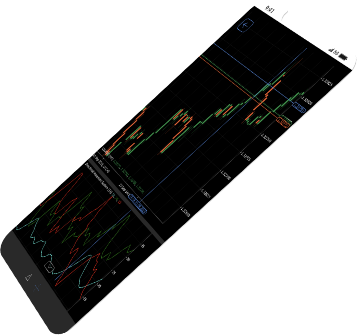

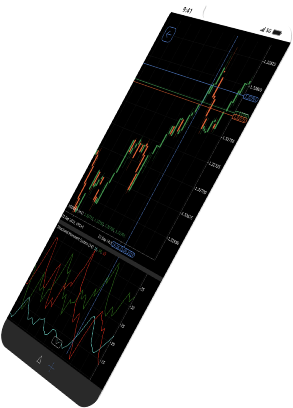

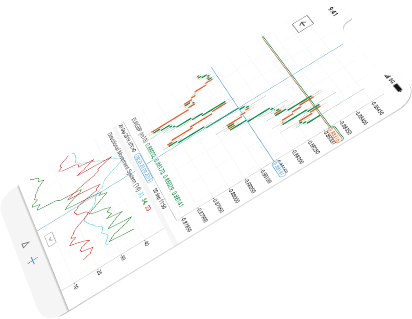

ECB leaves EUR/USD traders disappointed

Thursday’s ECB meeting ultimately left EUR/USD trading lower as traders questioned the near-term path for euro area rates. Granted, policymakers were crystal clear of a 25-bps interest rate hike in July, but they failed to specify the size of the hike indicated for September. Based on current assessment, the ECB anticipates a gradual but sustained path of further increases post the September meeting. In addition to today’s guidance on interest rates, the ECB announced an end to asset purchases from 1 July.

What’s clear from the decision and accompanying press conference is the ECB did not feel comfortable starting its tightening cycle with a 50 bps hike. When asked why, ECB President Lagarde stated that it was good practice to start with an incremental increase that is sizeable, not excessive, and that indicates a path. That felt like central bank speak for we’d rather not raise by 50 bps unless necessary.

President Lagarde, in her press conference comments, conditioned a larger than 25 bps hike in September on 2024 inflation projects being at or higher than 2.1%. She, however, also indicated that the Governing Council did not discuss the neutral rate at this meeting but conceded that it had likely gone down. Whether that is a hint that rates won’t rise by 50bps is not clear, nor did it indicate an unwillingness for the ECB to go above the neutral rate to tame inflation if necessary.

In today’s volatile markets, it’s difficult to extrapolate too much from forex market movements. But EUR/USD’s reaction to today’s announcement suggests currency traders were expecting more from the ECB in terms of the outlook for interest rates or found the downgrade to the ECB's euro area growth forecasts disconcerting. Why else would have EUR/USD ultimately fallen so sharply below its pre-decision pivot price. Looking ahead, it’s up to ECB speakers other than Lagarde to clarify the ECB’s position and potentially the EUR/USD’s direction.

Latest News

-

VARIANSE Launches Crypto CFDs

Jan 13, 2023, 3:30 PM

-

An Automated Trading Partnership: ClickAlgo and VARIANSE

Nov 16, 2022, 10:53 AM

-

VARIANSE Is Best Broker for Online Trading UK

Sep 15, 2022, 4:18 PM

-

AUD/USD: keep your eyes peeled on 0.72664

Jun 1, 2022, 11:40 AM