Trailing Stop-Loss: a Q&A With Top Trader Chris Tubby

- Trailing stop-loss is an important tool for traders

- A trailing stop-loss works best in volatile trending markets

How a Pro Trader Uses Trailing Stop-Losses

Last week, I had the opportunity to catch up with an old friend, Chris Tubby, to grab a cheeky afternoon pint and discuss English football. Half way through our session, the subject of trailing stop-loss came up, as I was enjoying a ride lower on EUR/USD, but worried about my take profits and losing out on pullbacks. Trailing stop-loss isn’t something I’ve entertained in the past, but I know others who use it religiously in their day-to-day trading.

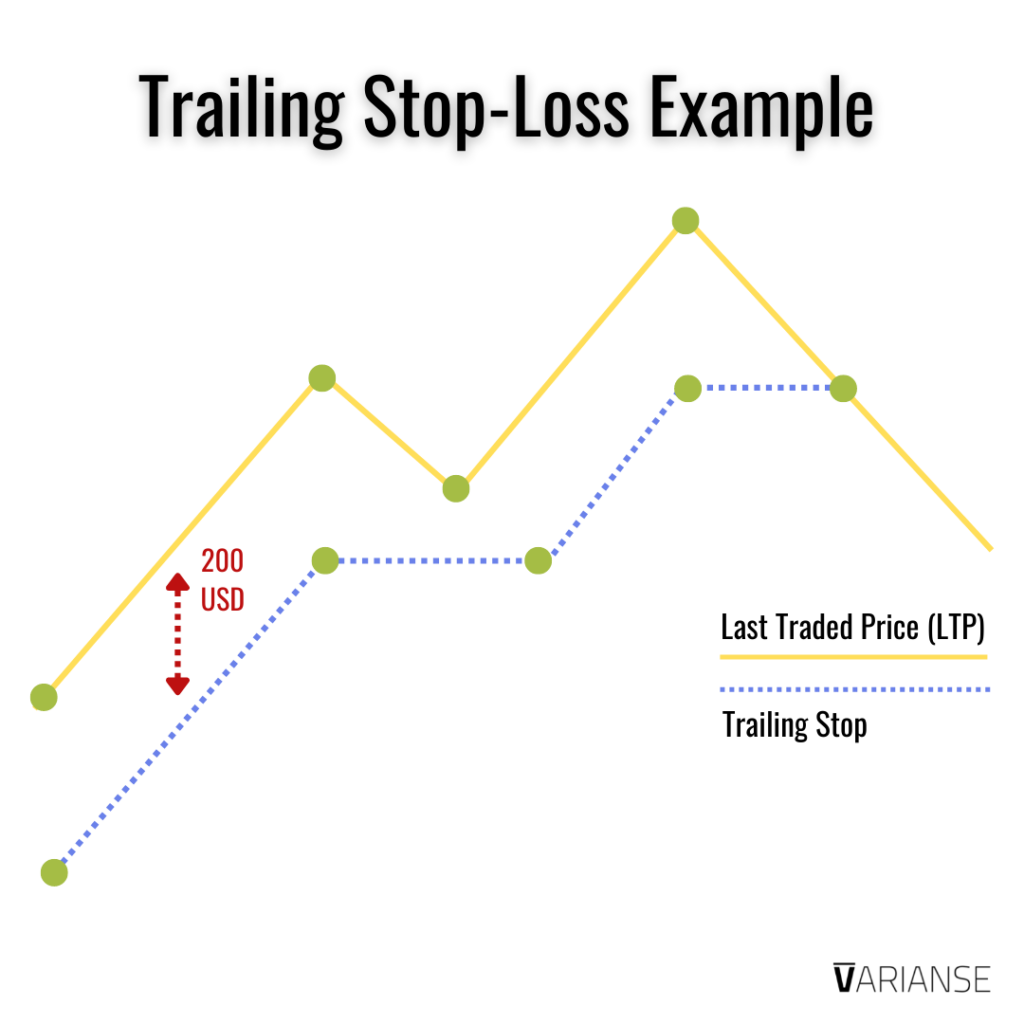

For those completely unfamiliar with the tool, a trailing stop-loss tracks price movement. Once opened, a trailing stop-loss adjusts as price moves in your favour and remains static when it does not. Should the price reach the stop loss, it will trigger the order and close the position. Traders use trailing-stop losses to protect their profits in the face of adverse price movements.

As a successful trader and educator, with over 4 decades trading experience, Chris was the perfect person to ask about trailing stop-loss. Coincidentally, he had more than a few open positions in oil as we spoke, which made the conversation all the more livelier.

Below are his answers to my most burning question on the topic:

Do Pro Traders Use Trailing Stop-Loss?

Pro traders develop their own style of trading that suits their character, therefore, trailing stop-loss usage varies considerably. I would say more conservative traders are likely to incorporate a trailing stop-loss, or if they struggle with knowing when to take profit as a trailing stop-loss removes the decision making.

Do You Use a Trailing Stop-Loss?

Yes I do use trailing stop-losses, but by how much depends on market conditions. Every trade is different! Generally, I use them more in volatile trending markets, where it is harder to judge where and when to take profit. I find that a trailing stop-loss keeps me in the trade for longer, in turn, I end up closing out my position at a more favorable price.

Also, I use a trailing stop-loss when my position is holding a healthy profit, but I feel there is potential for a lot more. Other times I will lock in profit on 50% to 70% and then use a trailing stop-loss for the rest. A trailing stop-loss is also my go-to tool when markets are trending and I’ve opened a trade, but I can’t devote extensive time in front of the screens.

How Do You Set Your Trailing Stop-Loss?

I look at candles on a short timeframe to gauge the recent cutbacks (short reversals), which generally come from profit-taking. For this, I can assess roughly how far away from the current price to set my trailing stop-loss. Sometimes I will set multiple trailing stops at different levels as a hedge against the cutbacks. Some may get triggered early, however, those further away might get to enjoy the ride for longer.

The key element of a trailing stop is how far away from the current price it should be set. Too far and you could lose a considerable part of the potential profit, If too close, it triggers too quickly and the opportunity is lost.

I don’t use a uniform level for my trailing stop. A lot depends on what I am trading. For example, having too tight a trailing stop-loss on commodities risks getting it triggered too quickly. On forex pairs, such as EUR/USD, I will place the trailing stop tighter due to lower volatility.

What Have You Been Trading Recently?

I trade all the asset classes and constantly monitor them for opportunities, with pivot points one of my key indicators. Oil has by far been my main trade due to the volatility. I feel very comfortable trading it as I used to be a market-maker/liquidity provider to both the major oil exchanges. Gold is another favourite, however, I have set levels in my head for the prices of interest.

About Chris Tubby

Chris Tubby is a veteran trader with over 4 decades of trading experience. He began his career in commodities in the 70`s, becoming a senior trader at the age of 22. From there, he transitioned to the financial futures markets when they arrived in London in `82. In the mid 80`s he opened his own proprietary trading company as well as providing execution for tier 1 institutions. He currently works at the Senior Director of Trading and Education at Symax Fintech.

His trading expertise is extremely varied – prop trading, multi-leg strategies and arbitrage. He spent many years as a market-maker for international exchanges (such as CME) on a variety of financial and commodity products. This included four years at an Italian bank, Fineco, in Milan as a market-maker and in London as part of a team providing liquidity to both the major oil futures exchanges (CME and ICE).

You can sign up for Chris's weekly newsletter here, where you can also enquire about the amazing things Symax has to offer.