4 Forex Risk Management Tips To Save Your Trading

- Forex risk management is integral to any trading plan.

- Monthly risk limits and dynamic position sizing will benefit your trading.

Don’t Fall for the Basic Rules

Forex risk management is integral to any successful trading plan. Yet the majority of forex traders, dazzled by some of the sexier aspects of trading, tend to overlook its importance. Those that do take note, usually just follow popular internet adages such as “don’t risk more than 1% of your account on a single trade” or “don’t risk more than 2% of your account at any given moment”, and still end up losing. Failure for them typically comes by a thousand cuts rather than at hands of two big bets.

Let’s face the facts, if everything you need to know about forex risk management could be boiled down to two throw away comments, big banks and hedge funds would not hire dedicated teams to manage trading risk. Of course, for most online traders such resources are way out of reach. But unless you are running hundreds of trading positions concurrently, neither are they necessary. Below I’ve listed some no-nonsense forex risk management techniques to integrate into your trading plan that will truly help improve your overall trading performance.

#1 Set Realistic Goals

Seeing people trying to double or even triple their accounts in a month or sometimes on a single trade makes me want to scream stop. Yes, you may get lucky once or twice, but if you’re looking to risk money gambling you may find better results at a casino. Inevitably these types of traders are consistent in only one aspect: blowing their accounts. Those seeking to make a long-term success out of their trading need to set realistic return goals so that they can properly proportion their risk.

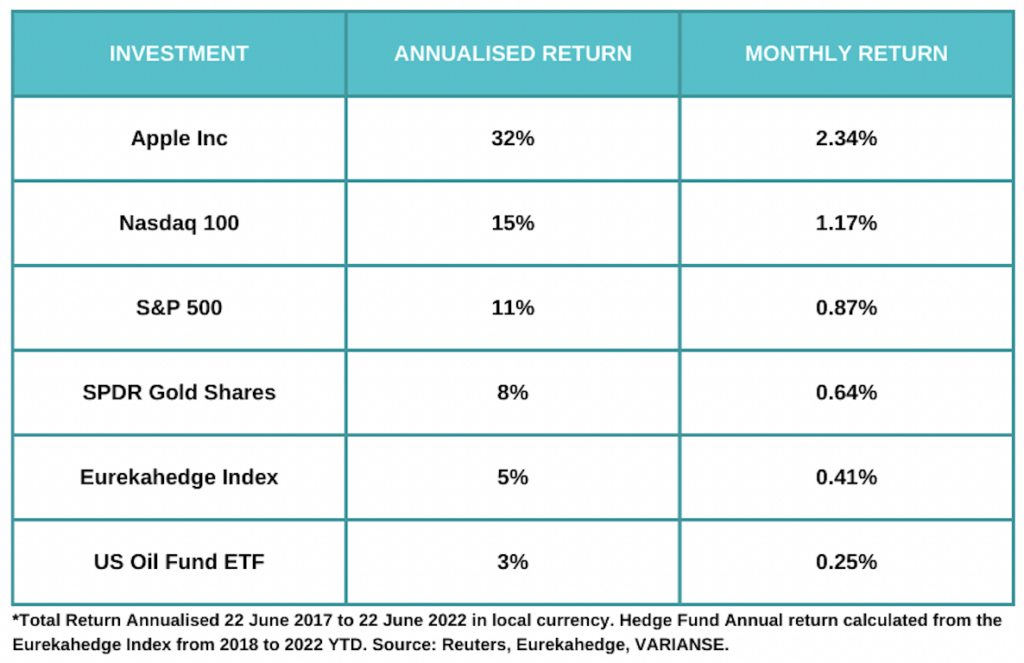

Hedge Funds, like most retail traders, typically employ leverage, so they provide a good example in terms of what to expect in terms of expected annual return. The Eurekahedge hedge fund index, which provides data on the total return of 3,428 different hedge funds, indicates that hedge funds over a five year period averaged about 5.4% in total returns a year. If we work back the required monthly return to achieve those results, assuming reinvestment of your winnings, then in order to mirror that hedge fund performance you would only need to return c. 0.44% a month.

Keep in mind hedge funds have a vested interest to remain solvent in order to keep on charging management and performance fees to investors, so they provide a pretty good proxy for a tight risk management setup. They also offer investors a level of portfolio diversification. Below I’ve put a table together of other asset classes with their historical 5 year average annualised return and monthly return equivalent with reinvestment to help sense check your goals.

#2 Risk Only What You Can Afford

You’ve probably heard the phrase “risk only what you can afford” countless times in regards to trading. That’s pretty wise advice because the money you commit to trading can easily be lost. Even institutions, like hedge funds, adhere to that concept.

Let’s say a hedge fund with $400m to invest has a star trader named Bob. Bob doesn’t get the full $400m to invest, he is usually only allocated a small percent to trade, maybe 10% or an initial $40m. Were Bob to have a great first month trading, adding $1m in profit to the firm, his available money to trade would also rise by $1m to $41m. In contrast, were Bob to lose that 10%, he would most likely no longer be trading for the fund.

Online traders, just like a hedge fund, should be equally disciplined. Poor performing traders should limit the money they devote to what they can afford. Likewise, they should also seek to allocate their profits back into their trading. Retaining your trading profits is important for several reasons:

- ensures that one can afford to lose any additional money in their account

- smooths out the capital available for you trade when monthly performance is choppy

- raises the probability of hitting your return target through compounding

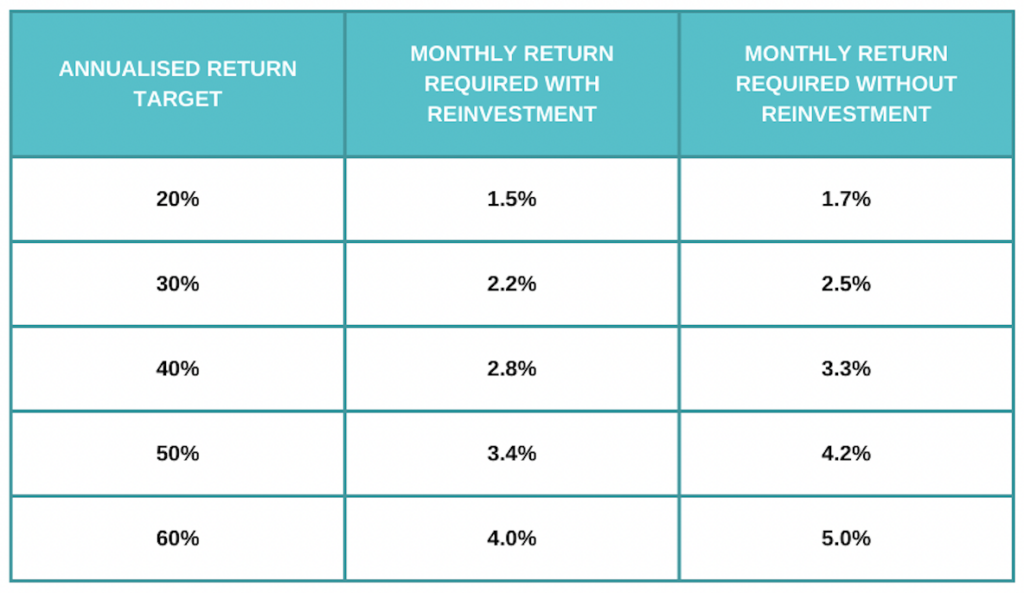

Traders who don’t retain their profits inevitably need to take on more risk to reach their ultimate goal. For example, if I didn’t reinvest my profits I would need to return a full percentage point more in return each month to reach my 60% annualised return goals.

#3 Monthly Dollar Limits

Once a trader has established their corresponding annual and monthly return goals and what amount they can afford to risk, the next step is to start apportioning their risk limits each month. The decision to assess risk monthly is not arbitrary. Month end is the perfect time to consider trading performance and strategy. In fact, most forex market participants, including big institutions, re-evaluate their trading positions on a monthly, quarterly, and year-end basis. Revisiting risk at month end is so prevalent there are trading strategies devoted to capitalising on its market effects.

Exactly how much money you decide to risk each month depends on the trader and the total amount of money they have committed to trade. For example, my monthly return goal is 4% and the money I’ve committed to trade is $2,000. Therefore, in order for me to hit my return target for the first month, I need to make a profit of $80.

The rest is largely based on the individual’s trading style. Based on my own style, I know the following:

- an average of 10 trading opportunities a month

- a risk-reward ratio of 2:1

- a win rate of 50%

- An expected return of 50% on whatever I risk on each trade

Therefore, I need to risk $16 on each of my 10 trades on average for a total risk limit of $160 a month. That equates to 8% of the total $2,000 I’ve committed to trade. Unless the parameters to my trading style change, I will make 8% of my total account value at the start of each new month. Whether the trader decides to allocate that entire monthly risk limit on a handful of high conviction trades or spreads it out across dozens of low conviction traders, if they risk and lose the entire limit then they stop trading for the rest of the month.

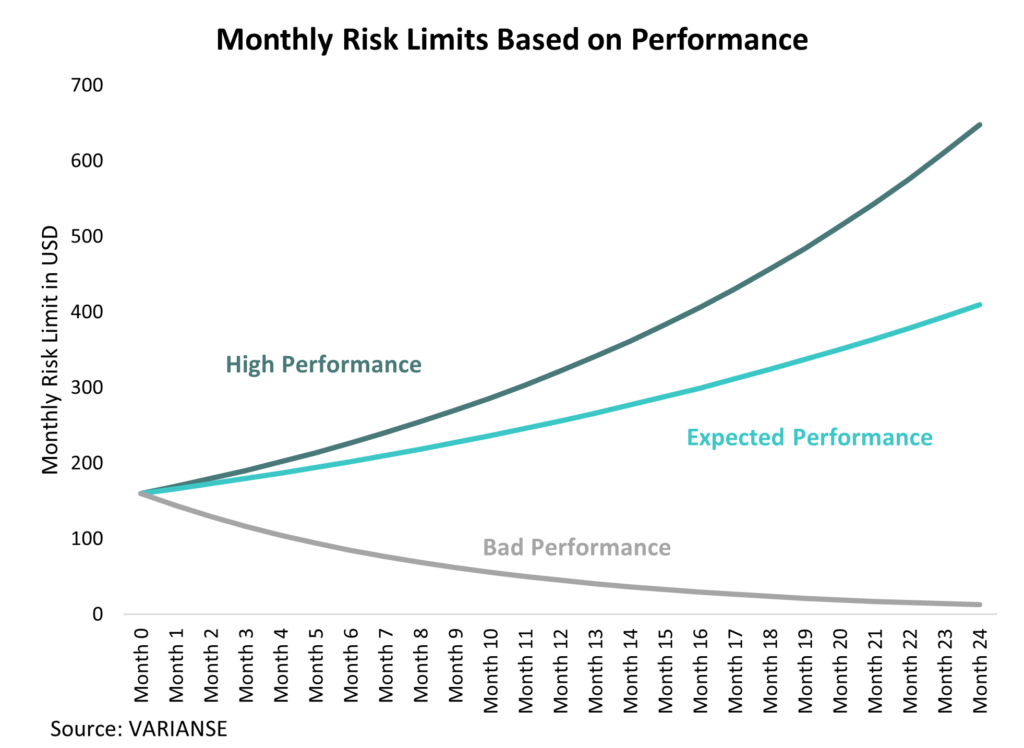

Pausing after a losing month gives traders an opportunity to reassess what they are doing wrong. In addition, it helps avoid some of the revenge trading that 9 times out of 10 causes traders to blow their accounts. When the new month rolls around, the losing trader can start trading again, except this time the amount of capital they have to trade is $147, 8% of the new account balance of $1,840. Every month the trader loses they are automatically penalised for performing poorly.

In contrast, were the trader to make their expected return, they would then benefit from a higher risk limit of $166 for the following month. The better a trader performs, the more they can risk in the following month. A good forex risk management system rewards for good performance and penalises for poor performance. When a trader meets their return target during a month they don’t stop trading but they should reduce the money they put at risk and only look for high conviction traders in order to preserve their returns.

#4 Risk Adjust Your Position Sizing

After setting unrealistic return goals, the number one mistake I notice traders make when it comes to risk management is using the same position size on all of their trades without regard to their level of conviction, any potential correlation to other trades they may be considering, or the underlying volatility of the proposed trade.

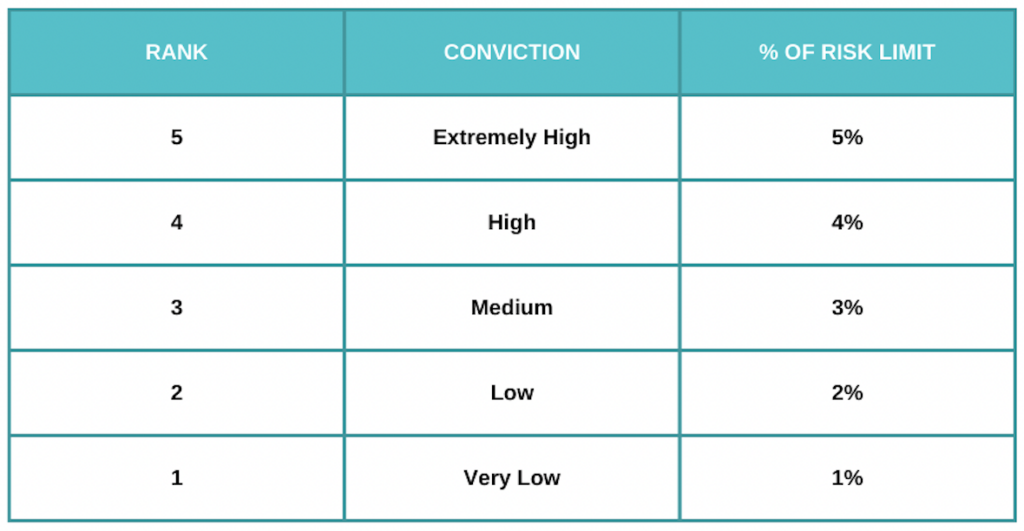

Forex trading opportunities exist every day, but they are not all created equally. Traders will inevitably be more confident about certain potential trades then they are about others. The amount of money traders risk against each possible trade should reflect the respective level of confidence. I personally employ a numeric scale from 1 to 5, with 5 reflecting the trades I am most confident about and adjust my position sizing relative to my month risk limits.

In addition, I also leave a bit of flexibility in my risk plan. If I am extremely confident about a particular trade, I leave open the possibility of risking a certain percentage of my total account rather than my monthly risk limit, usually around 5% of my total money available.

Once I establish how confident I am about each individual trade, I also need to adjust the amount I am willing to commit either higher or lower based on whether the volatility in the forex pair is lower or higher, respectively. In other words, a wider stop loss is required for relatively higher volatile currencies, which means I must naturally lower my position size accordingly. Investing.com provides a great free page dedicated to currency volatility to help traders make exactly this type of assessment.

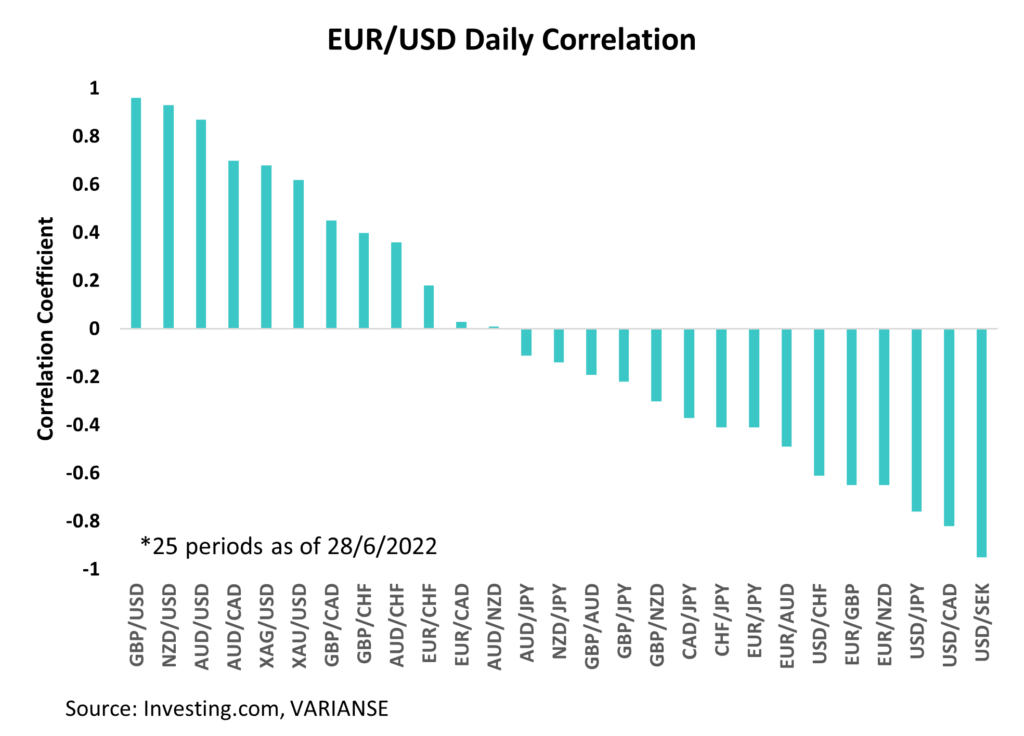

Lastly, I filter out the trades that are either highly positive or negatively correlated with each other. Buying or selling two highly correlated currency pairs will either end up leaving me taking on too much of the same underlying risk exposure or negate any potential future returns. By passing over or reducing the position size of highly correlated trades I’m better able to manage my actual risk exposure. Again, Investing.com has a dedicated free page to help you source accurate forex correlation data to assist traders in those efforts.

Forex Risk Management - Final Thoughts

Excellent forex risk management is definitely integral to any good trading plan. To borrow some terms from mathematics, finding great trading opportunities may be necessary to trade successfully, but good opportunities alone are not sufficient to perform over the long run. Every forex risk management tip I’ve outlined requires traders to plan, be aware of their performance, and measure their risks. There is no substitute for a strong trading plan that incorporates a well throughout approach to forex risk management. While traders can't control the direction of financial markets, they are always in full control of the money they put at risk.