cTrader: The Smart Way to Take Profit

- Scaling out helps you to take profit on trades that don't go to plan.

- Traders have multiple options when it comes to taking profit.

- cTrader let's traders automate multiple take profit positions.

Missing Your Take Profit?

You are up nearly 25 pips on your EUR/USD trade, but your 2 to 1 risk-reward target still leaves you a further 25 pips away from your take profit target. Following your trading plan, you hold out for the remaining 25 pips, only for the market to suddenly move adversely against you. By the time the dust settles, you've ended up triggering your stop loss to close your trade with a 25 pips loss. Despite getting the directional move of the forex pair correct, you still walk away with a big fat loss.

That scenario encapsulates one of the most common and frustrating situations loss making traders face regularly. I certainly did more than once early on in my trading career. Thankfully, a very practical solution called “scaling out” exists to tackle the problem. Better yet, the VARIANSE cTrader platform provides the built-in functionality to automate the process.

Scaling Out of Positions

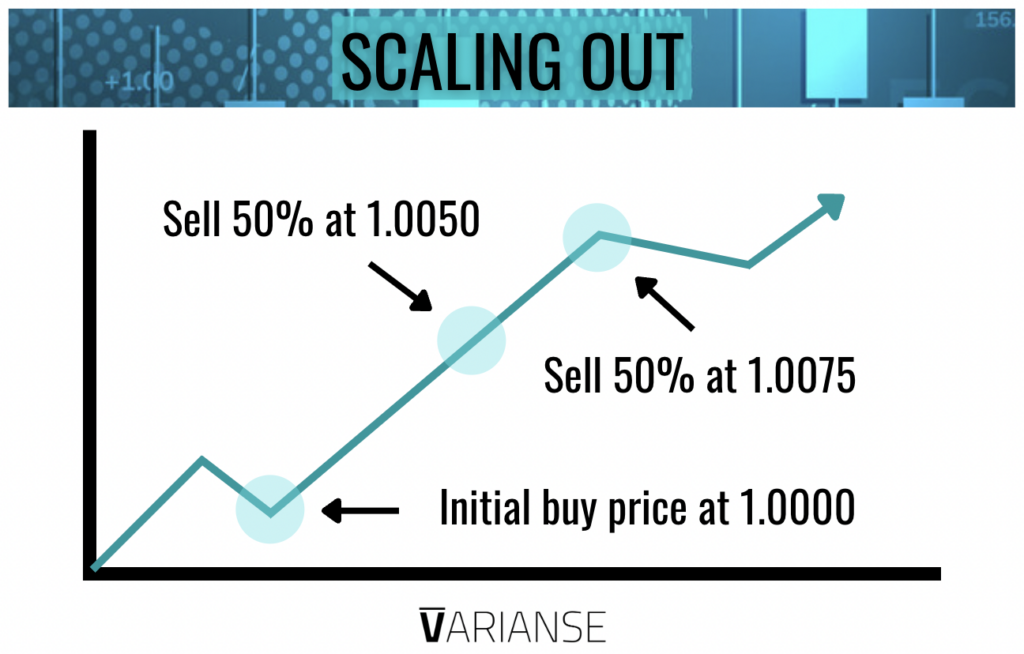

Scaling out is when traders take profit by reducing their position sizing as their trades become more profitable, rather than close them out altogether. This practice allows traders to take profit early, while simultaneously reducing their risk of loss. By doing so, however, traders do reduce the expected profit per pip each time they reduce their position size. In turn, that leads to a reduction in their total overall potential profit. Consider that the cost of profiting on what might otherwise be a losing trade.

Scaling out has several advantages over trailing stop loss, which tries to achieve the same result through different means. First, unlike trailing stop loss, scaling out puts the trader rather than the market in control in terms of when to exit a portion of the trade. Second, it provides much more optionality for traders to choose what levels and quantities they want to reduce their positions. All that is required is a little extra analysis in terms of both potential take profit levels and profit and loss calculations.

Worked Example

Let’s take a look at a basic example to better illustrate the technique. Trader X takes out a 1 lot long position in EUR/USD at 1.0000 equating to a profit of USD 10 pip. At trade initiation, they place a stop loss at 0.9975, risking USD 250. Their analysis suggests the price of EUR/USD could rise to 1.0075. At the start, forex markets work in their favour, the price of EUR/USD rises to 1.0050, netting them an unrealised profit of USD 500. Worried that the market may move against them from then onwards, the trader reduces his 100,000 unit position by 50,000, netting him a realized gain of USD 250.

Should the trade move against them, triggering their initial stop loss, they still end up in profit. By reducing their position by half, they reduce the potential loss per pip to USD 5, so their loss on his remaining open trade equals USD 125 ( 25 pips x USD 5 pips) That would leave them USD 125 in profit. Were the trader to reduce his position, but the trade to still move favorably to hit his price target of 1.0075, they would gain USD 375. A part of the profits would come from the USD 250 they received from reducing his position and USD 125 (25 pips x 5 USD a pip) from the position they decided to leave open. Had the trader not scaled out and the trade worked totally in their favor, the trader would have netted USD 750.

Different Approaches

The above represents just one worked example. In reality, traders can choose multiple levels at which to reduce their position size and by what degree at each. The bigger the reduction in positions and the closer they are to the entry price, the less risk but also the less profit the trader can expect on any given trade. No one size fits parameter exists to how a trader scales out their positions. Much depends on the specific trade in questions. Nevertheless, by employing some degree of scaling out, a trader will always reduce their capital at risk assuming the price hits one or more of their designated take profit levels.

Personally, I tend to scale out of positions in cases where either the conviction behind the trade is low or market conditions are volatile enough to question whether I will ever reach my desired take profit level. Others chose to scale out after they have reached their desired take profit but want to let a small portion of their existing trade continue to run in order to capture any further favorable market moves without sacrificing the bulk of their unrealised gains.

Also, I like to keep my approach to scaling out pretty simple. If my profit reaches the initial amount I put at risk when opening the trade, then I will scale out of half my position and also move my stop loss to breakeven (i.e. to the level I opened my position). By moving my stop loss to breakeven, I avoid making a loss altogether. In certain cases, where I assess more upside potential beyond my target take profit, I reduce my position more than one time to capture any further potential gains.

cTrader Functionality

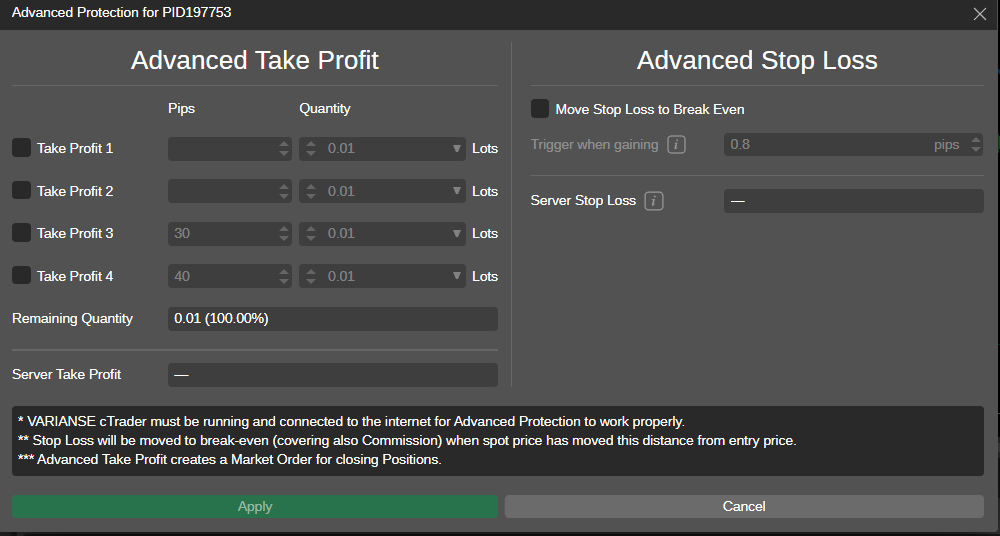

Before trading with the VARIANSE cTrader platform, scaling out of positions was a pretty manual process for me. Other broker platforms I used required me to enter my various take profit orders at different quantities separately or even worse manually monitor my positions. In other words, scaling out became a messy and stressful process. VARIANSE cTrader removes all the stress in terms of scaling out of positions by fully automating the process, The advanced order protection function on the VARIANSE cTrader platform makes scaling out of positions hassle free.

With the VARIANSE cTrader advance order protection function, traders can set four different take profit levels at whatever quantities they desire in an easy to use interface. That’s more than enough for most trader’s needs. Furthermore, you can also automatically set your stop loss to breakeven based on the number of pips gained. For someone like me, who regularly moves their stop loss to breakeven when scaling out, the VARIANSE cTrader is truly a godsend.

Final Thoughts

Scaling out is more than just about multiple take profit levels, it is also an important risk management tool that helps traders reduce their risk exposure. Scaling out is the perfect solution for traders who get the early direction of their trades right, but constantly find themselves missing their take profit level. In addition, it provides an opportunity for traders to let their positions run without risking too much of their unrealised profits. Giving more options than simple trailing stop loss orders, scaling out has never been easier using the VARIANSE cTrader advanced order function.