EUR/GBP: can the good times last?

Last week was big for EUR/GBP. The pair ended up by nearly 2% to close at 0.85498 – its largest weekly gain since the week closing 9 April 2021. Back in April 2021, EUR/GBP failed to hold on to those gains and subsequently ground lower to touch a low of 0.8208 by early May 2022. Will the same happen this time around or has there been a seismic shift in EUR/GBP prospects for the better?

What can be said for certain is that market conditions at that time were markedly different than they are today. EUR/GBP gains in April 2021 were largely attributed to profit taking. Prior to the strong weekly gain, EUR/GBP sharply off the back of COVID-19 vaccination rollouts in the UK. Thereafter, EUR/GBP continued to grind lower as the UK economy showed prospects of recovery.

Today, supply-chain issues, elevated global inflation, and war in the Ukraine are taking their toll on the post-COVID global economy. Last week’s Bank of England decision showed trepidation on behalf of the central bank to raise interest rates too aggressively in the future. Meanwhile, the ECB may quicken its end to QE and raise interest rates much sooner than previously thought even a few months ago.

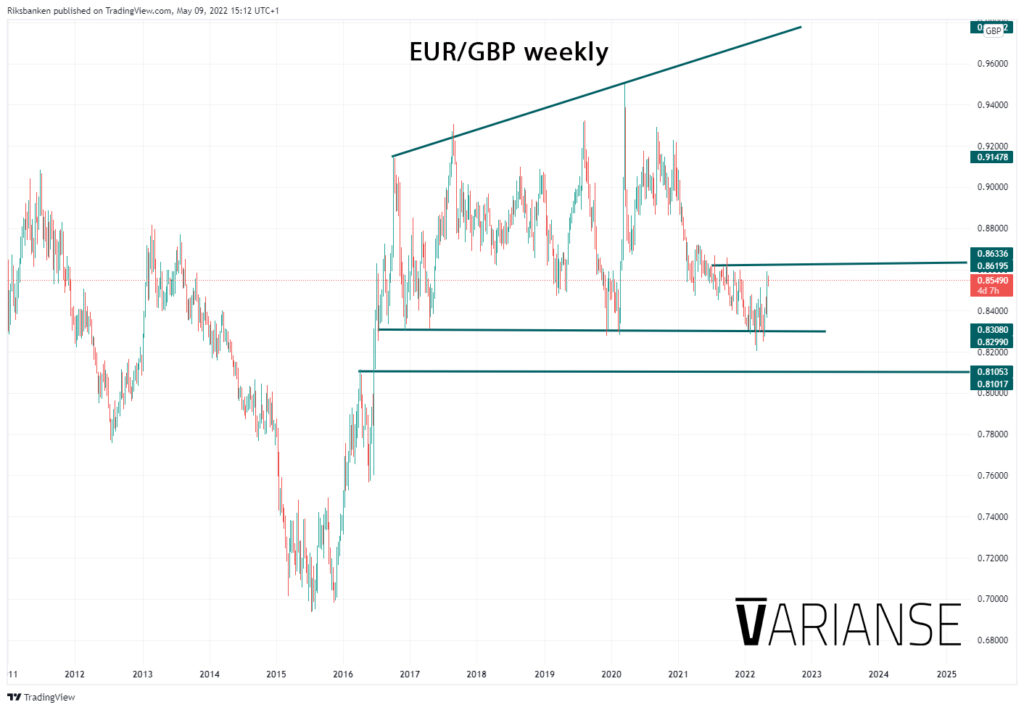

A stronger narrative for EUR/GBP this time around, however, doesn’t necessarily translate into a more positive technical picture. Although last week’s long candle is strong, its body represents just 72% of the total candlestick, shy of the 90% that would be more convincing of a continuation of gains. Furthermore, the pair is sitting at the bottom of a long-term broadening pattern where partial rises could lead to an eventual fall.

In the meantime, keep an eye our for the 0.8600-0.8666 as a key area of resistance both in psychological terms, but also because it marks the start of a resistance region established in the latter half of 2021. From there, a break above 0.87195 would open the window for more substantial gains. To the downside, a break below the 0.830 area would point to a potential drop to the 0.81172.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM