Is Bitcoin Really the New Gold?

You’ve probably heard parallels being drawn between Bitcoin and gold. Even the word mining, which means the coining of new Bitcoin, borrows its name from tradition metals extraction. But what could something so tangible as gold share with something so digitally ephemeral as Bitcoin? The answer is simple: a finite availability of supply.

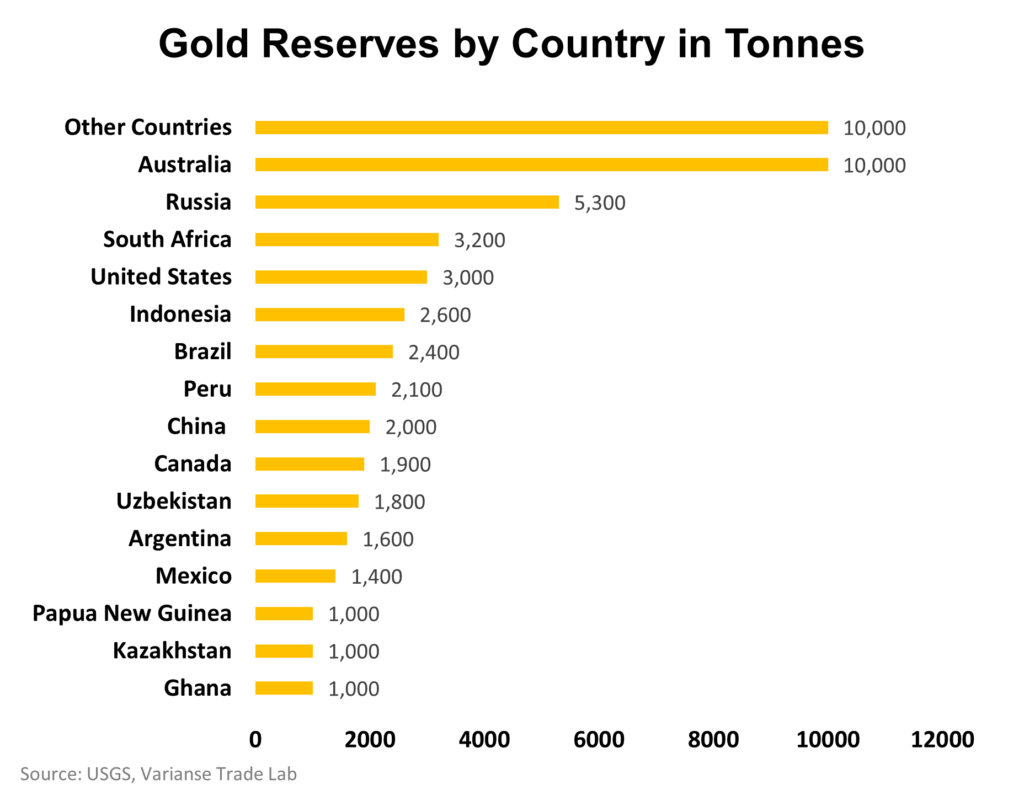

It is commonly known that gold as a precious metal is scarce. The world’s unmined gold resources are estimated at 50,000 tonnes versus the 150,000 tonnes already unearthed, according to the US geological survey. In other words, just 20% of the world’s gold has yet to be extracted. Granted, world supply could be improved by yet to be invented technology, but only by a modest amount.

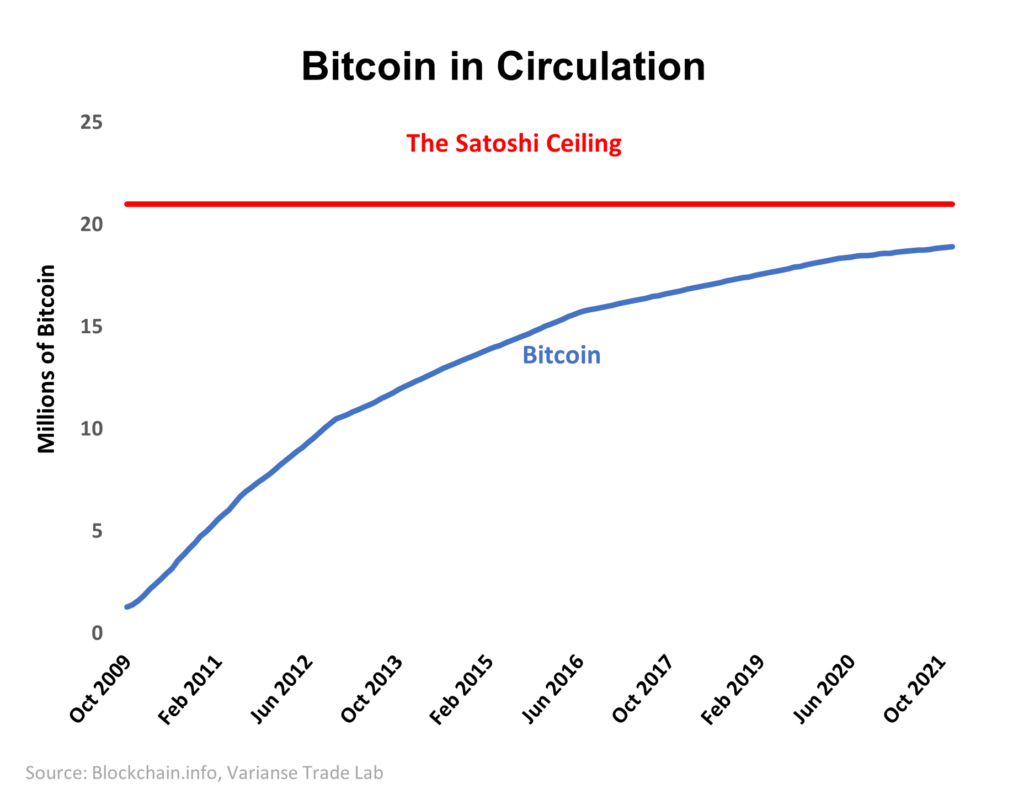

But you should be aware that the supply of new Bitcoin is even more constrained than for gold. Satoshi Nakamoto, the pseudonym used to represent the founders of Bitcoin, set a technical limit of 21 million on the amount of Bitcoin that could ever be produced. Today c. 18.5 million Bitcoin exist in the block chain, leaving a meagre 13% of the world’s possible Bitcoin supply yet to be mined.

Truth be told, the 21m is unlikely to be reached due to the rounding down of new coin creation and lost Bitcoin. Lost wallet keys and the death of Bitcoin owners who fail to share their wallets are some of the surprising ways of how Bitcoin can be lost.

Finite supply, however, is where the similarities between gold and Bitcoin start and stop. Unlike, Bitcoin, gold has physically been with humanity for ages. Use of gold in jewellery dates to 2600 B.C. Mesopotamia. Over millennia, gold has found use for decorative purposes, as a currency, in industry, medicine and underpins trillions worth of investment.

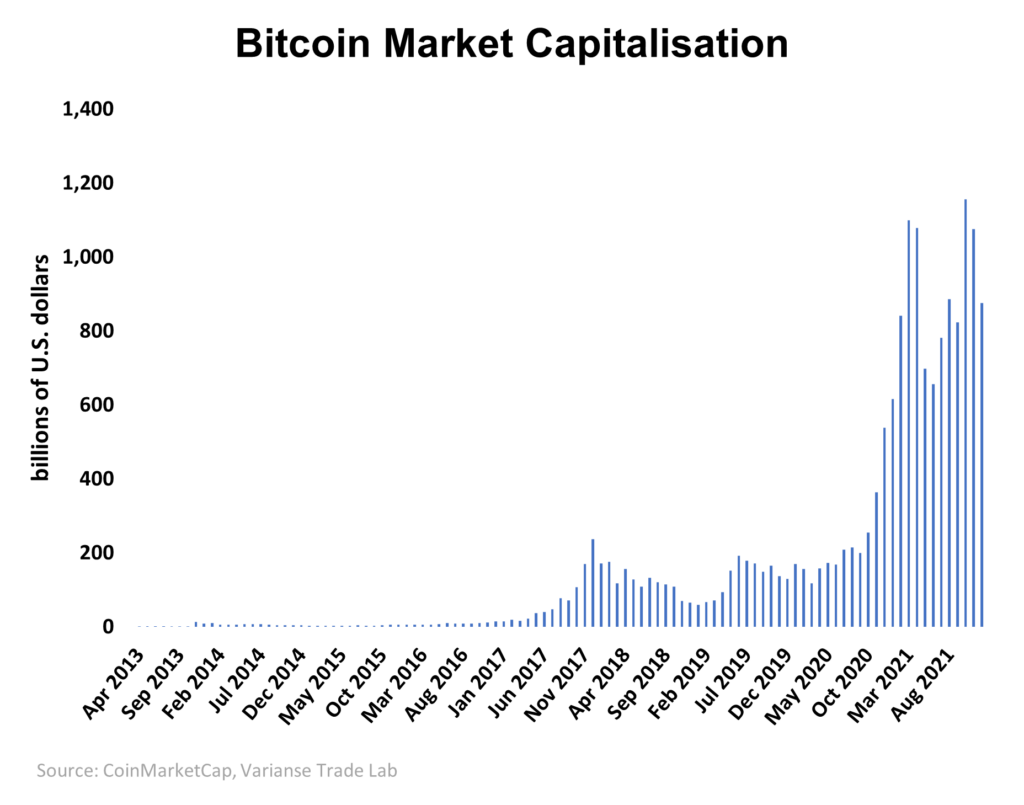

In contrast, Bitcoin is a digital currency created in 2009, which became available on tradable exchanges in 2010, but really didn’t explode onto the world’s stage as liquid tradable asset until 2016. It’s virtual, blockchain driven, has varied use cases, and is equally popular as it is controversial.

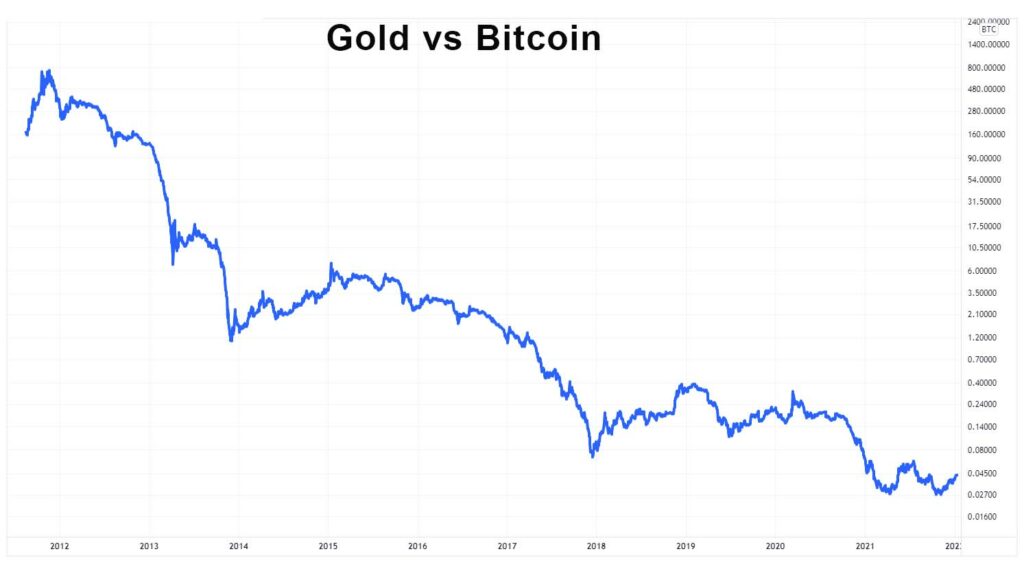

Such stark differences, however, hasn’t stopped investors from assuming Bitcoin represents a store of value in times of upheaval (aka a safe-haven) or as hedge for high inflation because of its finite supply, just as they do with gold. Nor is it just your basic investors who carries that belief, even if it has not been historically clear if either gold or Bitcoin really fits either role - a topic reserved for future article.

Goldman Sachs, as recently as January 2022, predicted that Bitcoin will steal a bigger share of the “store of value” market – possibly from 20% today to 50% in the near-future. Interest in Bitcoin is growing. It has grown to a market capitalisation of $700bn. Recent approval by the US Securities and Exchange Committee (SEC) recently is only apt to increase its allure.

Still, until then, it is clear that Bitcoin and gold haven't move in tandem. Since 2015, Bitcoin has made substantial gain versus gold. Whether that trend is likely to persist is one of the big questions facing Bitcoin and the wider crypto universe.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM