USD/JPY: BoJ intervention vs Godzilla US yields

USD/JPY soared to new heights on Monday as the Bank of Japan pledged overnight to keep interest lows against the backdrop of rising US bond yields. The latest swing higher put USD/JPY within a whisker of breaking through the June 2015 high of 125.85. Eisuke Sakakibara, a former top currency diplomat, identified the 130 as a potential level where the Bank of Japan may intervene to support the yen in a recent Reuters article.Doing so, however, would require the Bank of Japan to use some of its c. $1.38 trillion of currency reserves and consent from the rest of the G7 counterparts, most notably the US.

Even if the Bank of Japan were to intervene, there is no guarantee of success. Traders are more apt to test the central bank’s resolve in light of its commitment to keep monetary policy ultra accommodative. Meanwhile, any verbal rather than direct intervention risks keeping USD/JPY down only temporarily. The last time the Bank of Japan directly intervened to prop up the yen was back in 1998 during the Asian financial crisis. Japan’s export driven economy has historically left the Bank of Japan to take a more hands off approach in the face of yen weakness.

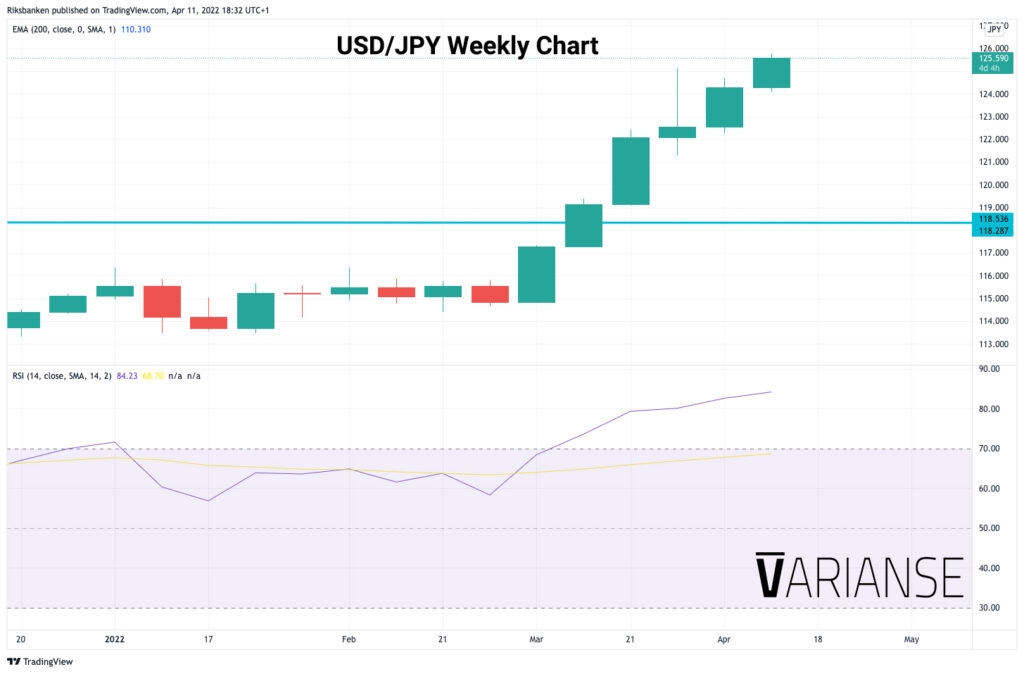

Nevertheless, the rise of the USD/JPY over recent weeks has been relentless. Back in late March, we were quick to highlight that the further above USD/JPY moved from the December 2016 swing high of 118.667 the bigger risk of a structural shift in the currency pair’s valuation. The market has moved far beyond that level now. That said, we’ve yet to see even a corrective move on the weekly timeframe as USD/JPY has soared higher, whilst we await confirmation of a new higher low on the daily chart. Traders should ponder those facts, and the risk of central bank intervention, and adjust any long position sizing accordingly.

Equally, traders with the guts to contemplate short positions should take consideration of the correlation between US yields and USD/JPY. The Bank of Japan’s commitment to ultra-accommodative policy really makes the yen’s performance more about what happens to US yields than what happens to those in Japan. Safer to look for confirmation that US yields may have topped out rather than solely relying on intervention from the Bank of Japan. The Bank of Japan truly faces a Godzilla challenge in terms retracing the yen’s losses in the face of ever higher US yields.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM