US Dollar smile theory will make you a better forex trader.

By Carl Paraskevas - Chief Economist

Dollar smile theory helps with the counterintuitive

Many presume that a strong US economy and high US interest rates translate into a strong US dollar and vice-versa. Granted, that may be true sometimes, but it doesn't hold true all the time. To increase your success at forex trading, it is always best to consider the US dollar in the content of the prevailing wider macroeconomic picture. Dollar smile theory helps to frame US dollar behaviour.

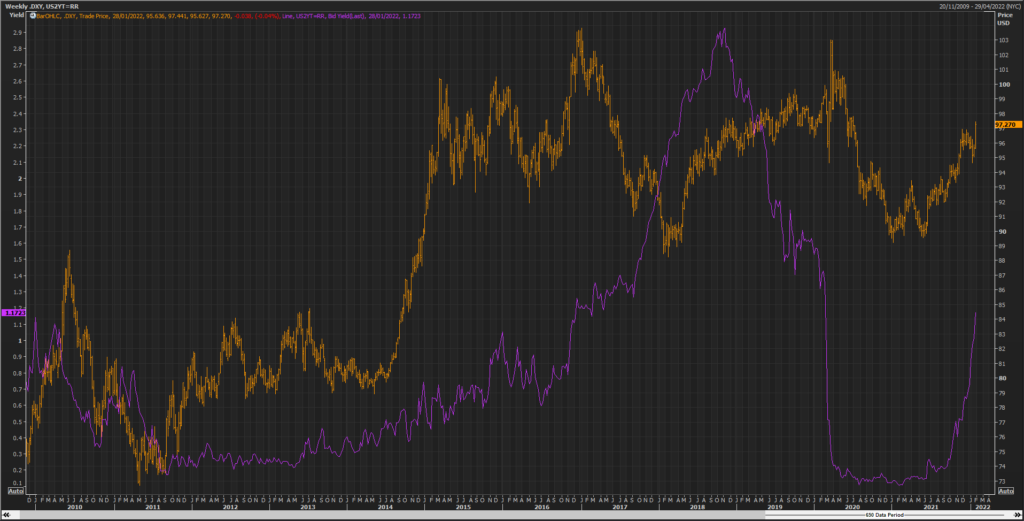

US Dollar Index (DXY) vs. US 2-Year Bond Yield

Dollar smile theory can help you

Stephen Jen, a former economist at the International Monetary Fund and Morgan Stanley, defined "Dollar Smile Theory" to provide traders and investors an easier way to frame what can sometimes seem counterintuitive moves in the US dollar.

Dollar smile theory

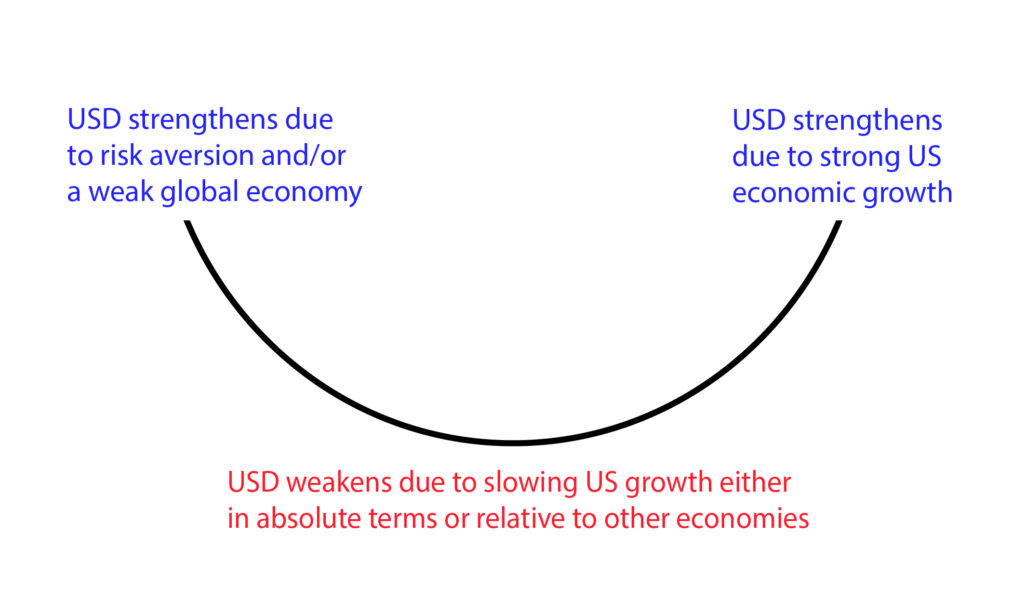

Breaking down dollar smile theory

The US dollar strengthens when the global economy is stressed or when risk aversion is high for other reasons such as heightened geopolitical tensions. At these times, the US dollar, the world's reserve currency takes on its safe-haven role. Global investors tend to plow their money into US Treasury securities for their safety, thereby selling foreign denominated securities and buying the US dollar.

Likewise, the US dollar can also strength when the US economy is preforming strongly. This is typically accompanied by the prospect of higher US interest rates leading to financial flows to US securities, which leads to US dollar buying.

A weaker US dollar usually accompanies slower US economic growth: both weaker in comparison to the past or on a relative basis with other economies. For example, in terms of the latter, if the difference between US economic performance versus the euro area narrows or inverts. Under these circumstances financial flows tend to flow out of the US and into foreign currency denominated securities, increasing US dollar selling.

Latest News

-

VARIANSE Launches Crypto CFDs

Jan 13, 2023, 3:30 PM

-

An Automated Trading Partnership: ClickAlgo and VARIANSE

Nov 16, 2022, 10:53 AM

-

VARIANSE Is Best Broker for Online Trading UK

Sep 15, 2022, 4:18 PM

-

ECB leaves EUR/USD traders disappointed

Jun 9, 2022, 4:26 PM

-

AUD/USD: keep your eyes peeled on 0.72664

Jun 1, 2022, 11:40 AM