Interest rate spreads: trade forex like a Master of the Universe

By Carl Paraskevas - Chief Economist

Interest rate spreads are one way good way to predict the future of a forex rates

Forex is sensitive to interest rate spreads

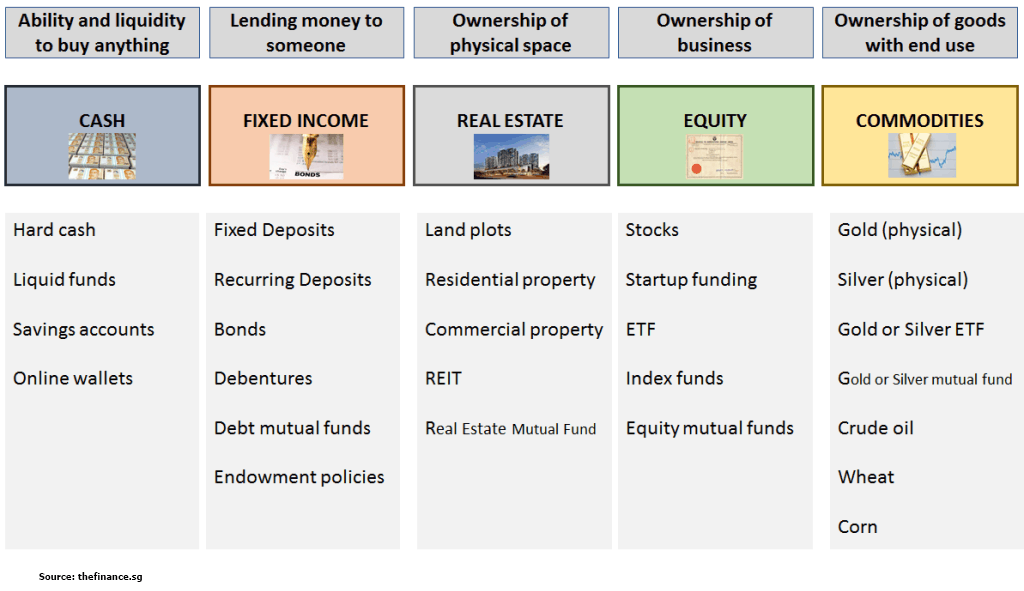

When you trade forex, you aren’t trading an asset in the truest sense. Unlike bonds or equities, pure forex doesn’t pay a cash flow. You either need to invest it in a true asset or deposit into a bank to gain interest. That’s why developed market forex is so sensitive to relative shifts in interest rate spreads between the countries they represent.

Types of asset classes

Interest rate spreads

When the difference between interest rates in country A and country B rises, the value of the former’s forex rate versus the latter tends to rise in tandem. Conversely, when forex interest rate spreads falls, the forex rate between country A versus country B tends to fall. This is because money flows to and from different countries based on relative change in expected interest rates.

Forex traders tend analyse the difference or spread between interest rates on either 2-year or 10-year yields of interest rate swaps or government bond rates, or a combination of both. Why look at longer-term interest rate spreads rather than policy rates? Longer-term interest rate spreads include more informational value in terms of what the markets are anticipating for policy rates in the future than shorter-term interest rate spreads.

EUR/USD vs EU-US 2yr bond yield spread

Interest rate spreads & forex rates

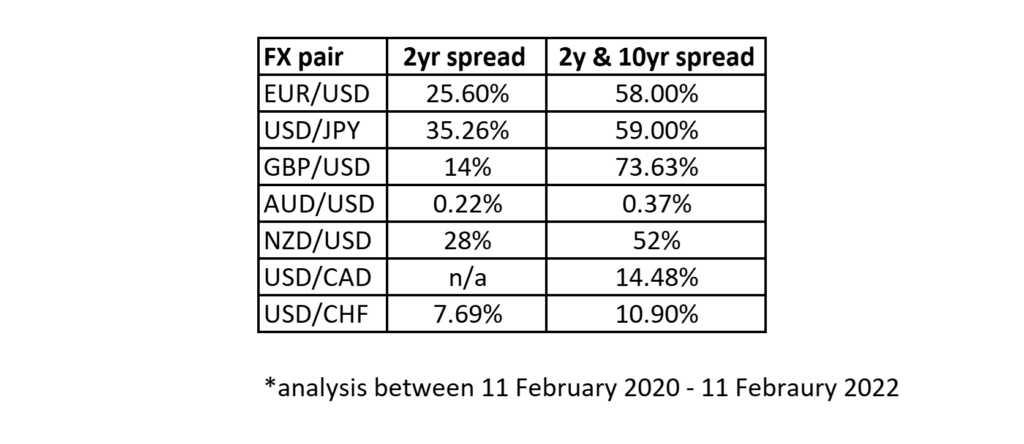

Across most major developed forex trading pairs, the positive relationship between interest rate spreads and the direction of the forex rate in question tends to hold up. That said, forex interest rate spreads tend to explain the variability of forex rates to varying degrees across currency pairs.

Explanatory power of interest rate spreads

For example, for big commodity exporting countries such as Australia, yield spreads explain very little in terms of forex rate variability. Likewise, the results for Emerging Market currencies, also tends to be poor for various reasons. EM currencies are either under a forex rate regime, tend to be more closely correlated with growth and inflation dynamics, are more exposed to political risk, etc.

How to incorporate spreads into your trading

Predicting yield curve movements in various countries, however, is risky business. If you have deep convictions about how interest rate markets will perform, you certainly can you use them to help guide your predictions about forex rates. But professional forex traders tend to look out for moments of divergence: when forex interest rate spreads and forex rates move in opposite directions.

If a forex rate moves in the opposite direction of its corresponding forex interest rate spread, it should lead you question whether the market confidence underlying the move in the forex rate. But we warned, forex movements are certainly not always explained by interest rate moves 100% of the time. Forex rates move for all sorts of reasons. Spreads are just one more tool in your tool kit to help you become a more successful trader.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM