What does ECN account mean in forex trading?

By Carl Paraskevas - Chief Economist

ECN account is a crucial term to know when you are on the hunt for a forex broker.

Looking for a new forex broker, whether you are a novice or seasoned trader, isn’t always fun. Forex traders find themselves comparing platforms, service levels, spreads, minimum deposit requirements, etc. Yet many neglect to consider one of the most important attributes: how their broker executes trades on their behalf. That’s why understanding the term “ECN account” is crucial.

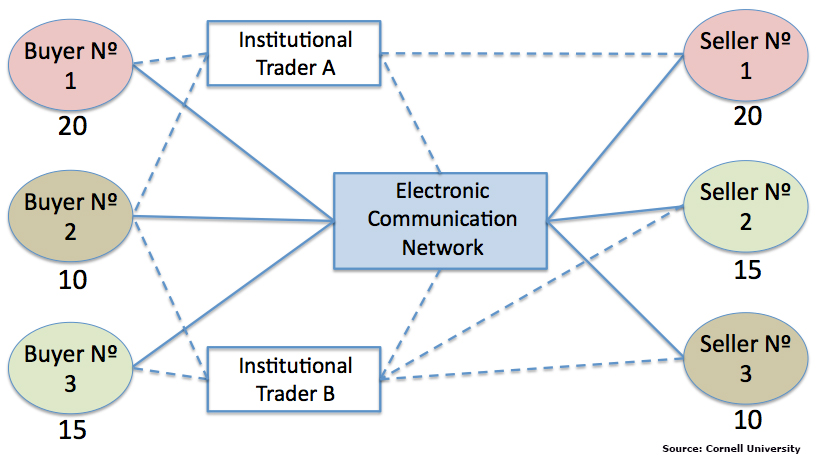

ECN stands for electronic communication network. These networks are the electronic exchanges where the big banks, brokers, and investment funds trade forex. Think of them as the New York Stock Exchange or London Stock Exchange, but for forex instead of stocks. Brokers that offer true ECN accounts give you the best available quotes from these networks.

Razor sharp spreads are the most obvious advantages to having an ECN account, but they aren’t the only one. Equally important, ECN accounts eliminate “re-quoting”; when a forex broker can’t fill your order at the price you requested. With an ECN account, you 100% tapped into the real market 24 hours a day 5 days a week.

Furthermore, as everything is done electronically, the room for human error is virtually zero. Trade, order, execution, and settlement are handled immediately.

Meanwhile, the disadvantages of not having an ECN account are immense. Brokers that do their own market making. i.e. don’t source their prices directly from the forex market, are more apt to offer wider spreads, quote prices that are less reflective of market conditions, and provide less price transparency.

The bottom line, always make sure you have an ECN account to take advantage of the best trading conditions.

Latest News

- VARIANSE Launches Crypto CFDs Jan 13, 2023, 3:30 PM

- An Automated Trading Partnership: ClickAlgo and VARIANSE Nov 16, 2022, 10:53 AM

- VARIANSE Is Best Broker for Online Trading UK Sep 15, 2022, 4:18 PM

- ECB leaves EUR/USD traders disappointed Jun 9, 2022, 4:26 PM

- AUD/USD: keep your eyes peeled on 0.72664 Jun 1, 2022, 11:40 AM