GBP/USD Falls After 50 bps Hike

- BoE hikes bank rate by 50 bps to 1.75%

- GBP/USD falls in reaction to weak UK growth forecasts

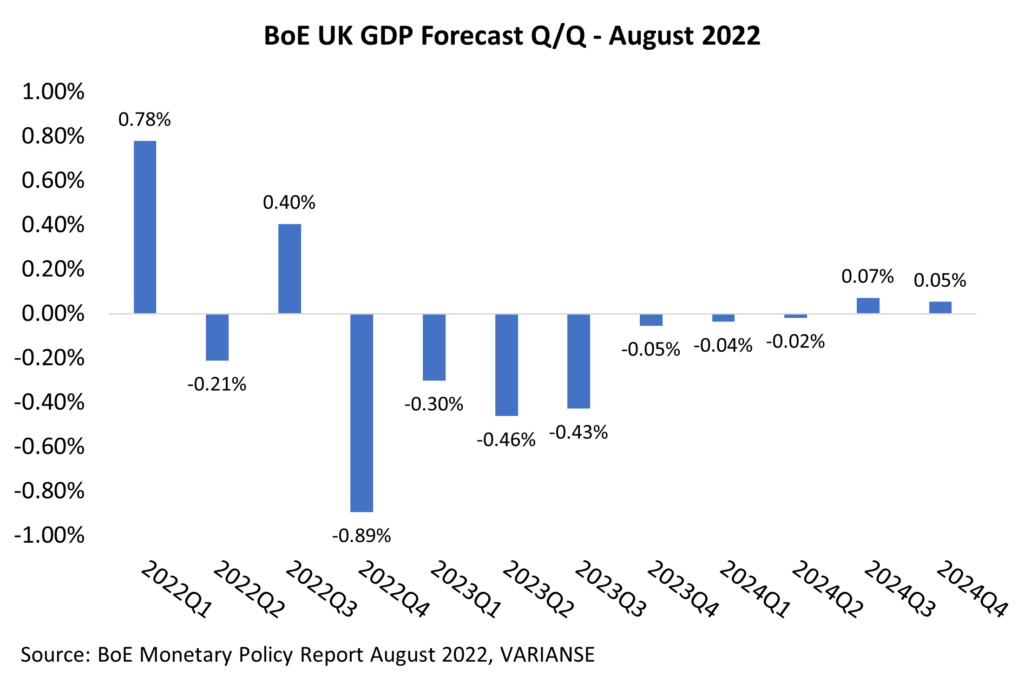

BoE GDP Forecasts Shock

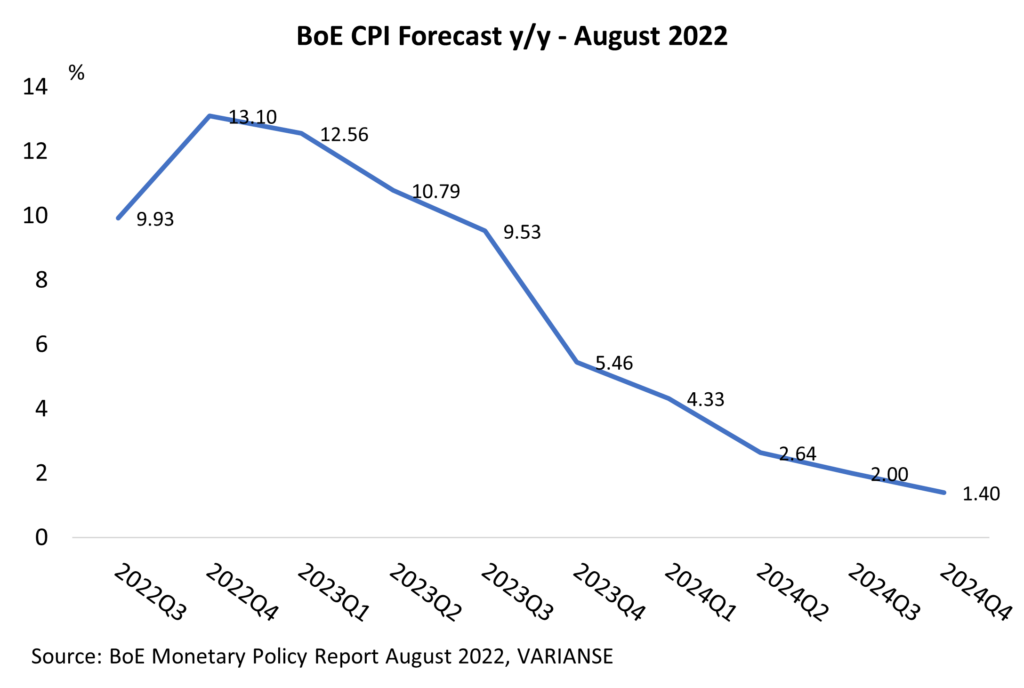

“Expect the unexpected”, said Oscar Wilde, the famous Irish poet and playwright. That certainly has proven true in relation to Bank of England policy as of late. Thursday’s monetary policy decision was certainly no exception in that regard. This time around, however, it wasn’t the 50 bps hike that has taken the bank rate to 1.75% that proved surprising. Both interest rate markets and the majority of economists had anticipated the move. Less expected, however, was downward revisions to the Bank of England’s UK GDP forecasts, which now point to a technical recession starting in Q4 2022 and persisting throughout 2023. Meanwhile, fresh inflation forecasts point toward CPI inflation topping out at 13.1% in Q4 2022, and remaining persistently high, before dropping sharply from Q3 2023.

GBP/USD Reacts Badly

Unsurprisingly, GBP/USD fell sharply on the news. At the time of writing, the pair was down by nearly 0.23% on the day to trade at 1.2115. Slower expected growth and persistently high inflation clearly highlight the challenges the Bank of England faces in getting inflation under control. Weaker expected growth, in particular, raises serious questions about the central bank’s capacity to raise interest rates as aggressively going forward. As a result, UK 2-year yields ticked lower, down by 10 bps at one point during the day. Thursday’s 50 bps hike appears to be an attempt by the BoE to front load interest rate hikes now to avoid the chance of more aggressive hikes in the future. In turn, this suggests the BoE will struggle to keep pace with the Fed in terms of policy tightening.

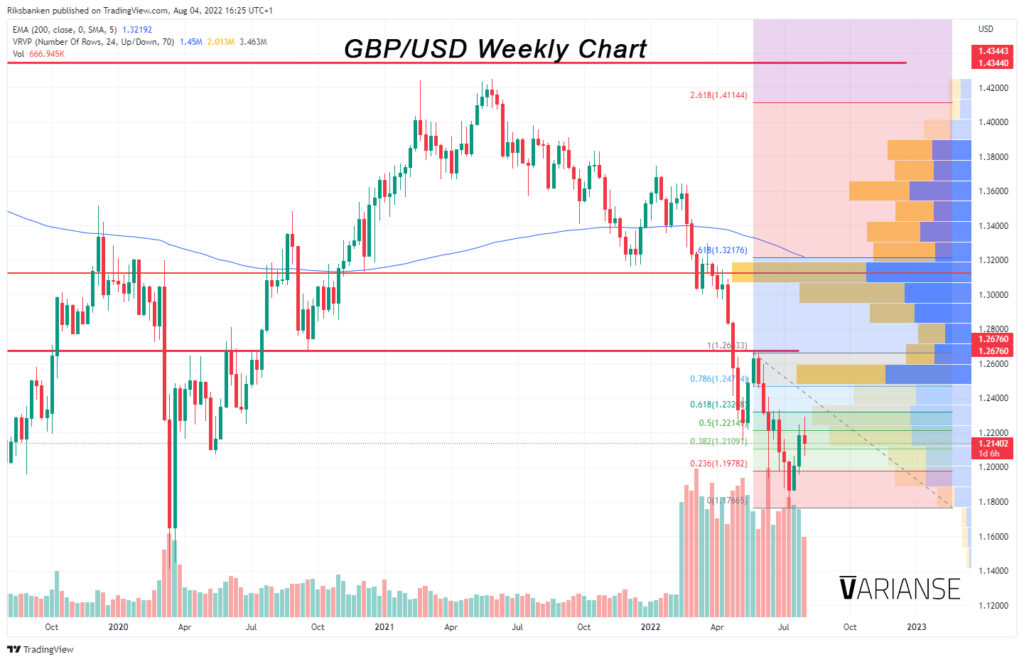

Charts Look Pessimistic

It’s not just the fundamentals that appear pessimistic GBP/USD. Be it on the higher weekly or the lower daily timeframe, GBPUSD is trading well below its 200-day exponential moving average. Furthermore, from a market structure perspective, GBP/USD is clearly still also pointing to a clear downtrend since the start of 2022. Price is now sitting close to the halfway mark between the prior May corrective swing high of 1.22670 and July swing low of 1.17603, leaving the pair primed for further losses after Thursday’s decline. Were price to break above the 1.26760 level, which has proven to be a strong pivot level, that might restore more confidence in the pair. Alas, at the moment, the market is far away from that level.