USD/JPY: Cautious Ahead of the Fed

- USD/JPY's ascendance showing potential signs of cooling

- Insufficient evidence yet of any dramatic retracement or reversal

- 135 and 131.50 are key levels to watch

Warning Signs Flashing

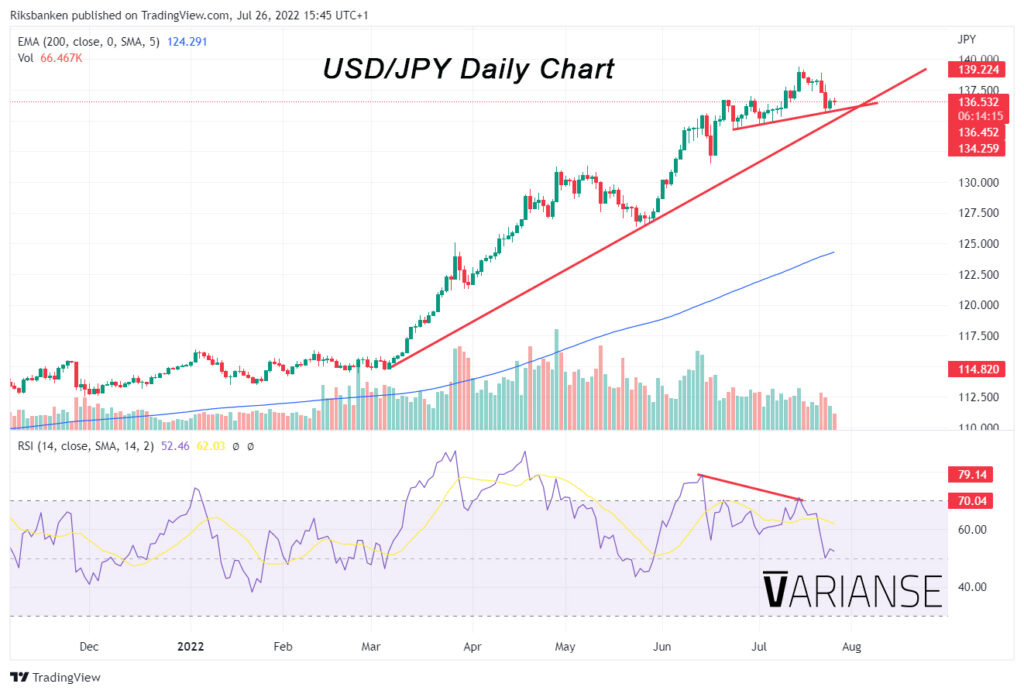

USD/JPY has been one of the latest entries into my higher frequency watchlists after price failed to make a substantive new higher low on the 22 July. As a result, I’m more vigilant for possible signs of reversal and see some pretty big risks buying ahead of Wednesday’s Fed decision. I’m too worried that either the 21 June 22 high of 136.710 or 29 June 22 high of 137.005, mark the first shoulder in a yet to be formed head and shoulders pattern or set the path toward a double top or triple tip formation. RSI divergence between the 14 June swing high of 135.495 and the subsequent 14 July swing high of 139.394 also adds to my new found caution.

Waiting for a Catalyst

Still, ample evidence to suggest that USD/JPY has reached its peak is lacking. Granted, down by c. 19% against the US dollar year to date, the Japanese yen has been the worst performing currency, but that alone doesn’t mean it is ripe for a reversal. Most of the fundamental conditions that have led the pair higher haven’t shifted; aggressive Fed tightening vs. ultra loose monetary policy from the BoJ persists, as do high energy prices and fears of global recession. In my opinion, the fundamental catalysts needed to reverse the yen’s fortunes, although brooding, have yet to appear.

Key Levels to Be Broken

Likewise, price is still well above its 200-day exponential moving average. This makes me cautious of being too bearish USD/JPY, even if the gap between the current price and the moving average look extreme. Were price to break below 135 underpinned by decent volumes I might become more convinced that USD/JPY’s fortunes have taken a shift for the worse. Even more substantive, would be a sustained break below the 131.50 level. At the moment, we are still a long way off from that level.