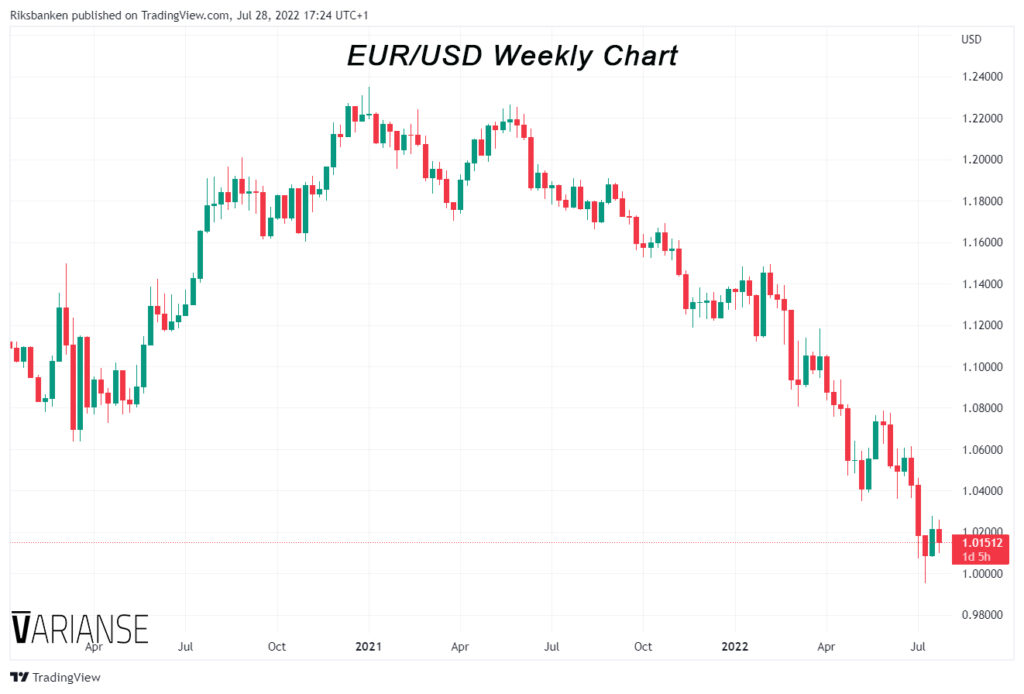

Fed Hike & US Growth Weigh on EUR/USD

- Global recession concerns play to the US dollar's safe haven status

- ECB is likely to struggle to keep pace with the Fed

US Enters Technical Recession

No matter what the office of the President of the United States argues, the US economy officially entered a technical recession in Q2 according to data released on Thursday. A technical recession being defined as two consecutive quarters of GDP contraction and not to be confused with other definitions of recession. US Q2 GDP contracted by 0.9% in Q2 following a 1.2% contraction in Q1. Under certain circumstances, one might assume that a shallow US recession might be negative for the US dollar and positive for the euro. But the performance of EUR/USD over this week would suggest otherwise. At the time of writing, EUR/USD was down 0.55% heading toward the end of this week. I would suggest that there are three good reasons why EUR/USD is down and not up this week.

Global Growth Concerns

First, in the current market context, a slowing US economy adds to already elevated concerns over the global economy. Data on Friday is likely to show that Euro area GDP growth slowed to 0.2% in Q2 from 0.6% prior, but the risks to the number are titled to the downside. GDP growth in China also disappointed in Q2, expanding by 0.4% in June versus an expected 1%. Meanwhile, GDP growth in the UK appears to be only just keeping in positive territory in Q2, but the first estimate of Q2 GDP won’t be available until the 12 of August. For the moment, fears over global rather than just US growth play to the US dollar’s safe haven status.

ECB May Struggle to Keep Pace

Second, there are still big question marks over how well the euro zone economy can withstand further interest rate hikes from the ECB. The ECB raised interest rates by 50 bps in July to take their key policy rate to zero - its first rate hike in 50 years. But question marks remain in terms of how well the central bank will be able to keep pace with the US Federal Reserve. Likewise, similar questions are being asked about the Bank of England. Headline euro area inflation is running at 8%, which without a sufficient monetary policy response is likely to weigh rather than support the euro.

Fed Remains Committed

Last, but certainly not least, the Fed still seems committed to bringing down inflation at the cost of the US economy. This was evidenced by a further 75 bps hike from the central bank on Wednesday, despite evidence of slowing US growth. So, the US dollar is benefiting from both higher US interest rates and safe haven flows due to fears of a global recession. For the moment that narrative remains unchanged. Earlier in July, I highlighted the potential for the recent retracement in EUR/USD above parity might provide new short position opportunities. Those opportunities may come at levels lower than I previously anticipated.