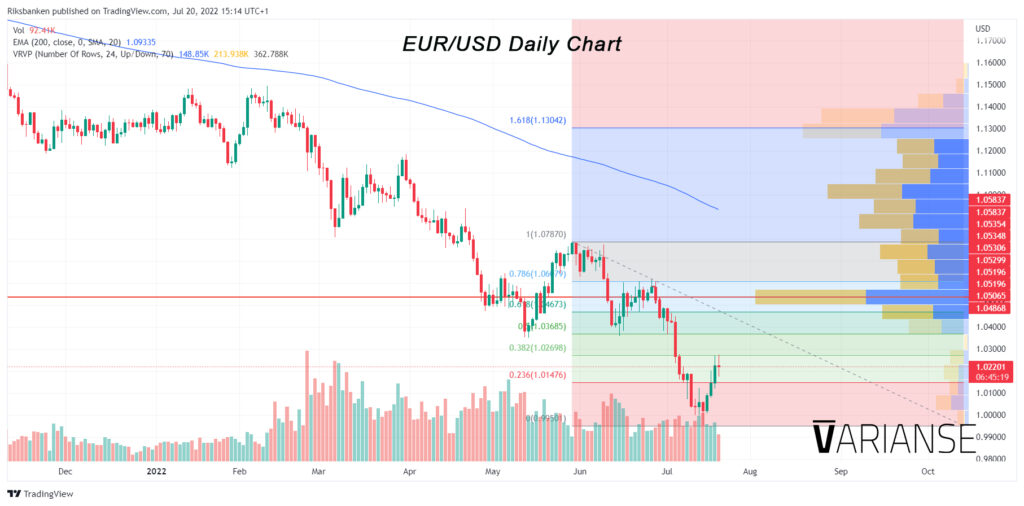

EUR/USD: Retracement Mode at the Moment

- EUR/USD stayed at or below parity only briefly

- The 1.036 region and 1.050 region are possible resistance levels

A Brief Moment Below Parity

Life for EUR/USD at or below parity thus far has been short and sweet. Rather than punch, the pair gently lapped past parity between 12 and 14 July, before receding back above that level in recent days. Still, the 14 July swing low of 0.9952 stands out in the wake of the recent retracement higher in price. Meanwhile, the simplest of technical indicators, such as the 200 daily and weekly exponential moving average are tilted downwards; the current price of EUR/USD is well below the moving average line. This, alongside the absence of that big capitulation moment in EUR/USD, where sellers completely exhaust themselves on massive volume, in my opinion, risks a further move beyond the newly established precipice of 0.9952.

Retracement Opportunities

As a result, I’m keeping my eyes peeled for attractive levels to re-sell EUR/USD, on the possibility of further retracement. Until price makes a sustained break above the 30 May swing high of 1.07870, which would mark a structural shift from downtrend to uptrend, I’m more apt to look at opportunities to sell EUR/USD rather than buy. I’ve got my eye on the key Fibonacci retracement levels between the swing high of 1.07870 and 0.9952 swing low as possible levels for the current corrective move to reverse. These include the 50% Fibonacci retracement level of 1.03685, and also the 1.05 region where there is a great deal of past congestion and volume, amongst others.

Keeping a Tight Lid on Risk

Against those key Fibonacci levels, I’m looking for strong signs of possible reversal, whether they be candlestick patterns, traditional chart patterns, or other similar signals. In addition, I will judge my position sizing against the degree of relative volume that validates that potential. I always can size up my position by scaling in at a later date. But based on previous volume, I wouldn’t be looking to do that until price has successfully broken below parity again and downside momentum looks set to continue.