GBP/USD: May GDP Tilts the Narrative

- UK data next week could be make or break for GBP/USD

- 1.16 could prove to be a key psychological level

Better-Than-Expected May GDP

UK monthly GDP rose by a better-than-expected 0.5% m/m in May, according to data released on Wednesday. That number was certainly better than the 0% economists were expecting. In addition, it represents a decent improvement from the revised 0.2% decline in April. As a result, the UK economy may just avoid slipping into quarterly contraction in Q2. Whether this will be enough to solidify a 50 bps rather than a 25 bps hike from the Bank of England when it next meets on 4 August 2022, is an entirely different matter.

Still Loads of Uncertainty

Despite the better-than-expected figure, UK household spending on certain categories of goods and services appeared strained. This suggests a contraction in economic activity in Q3 still on the cards. A more accurate picture of Q2 activity won’t be available until the release of the first full estimate of Q2 GDP on the 12 August 2022, well after the Bank of England meeting. Until then, expect next week’s UK employment data and June CPI data to carry extra weight, both for the Bank of England decision and the immediate fortunes of GBP/USD.

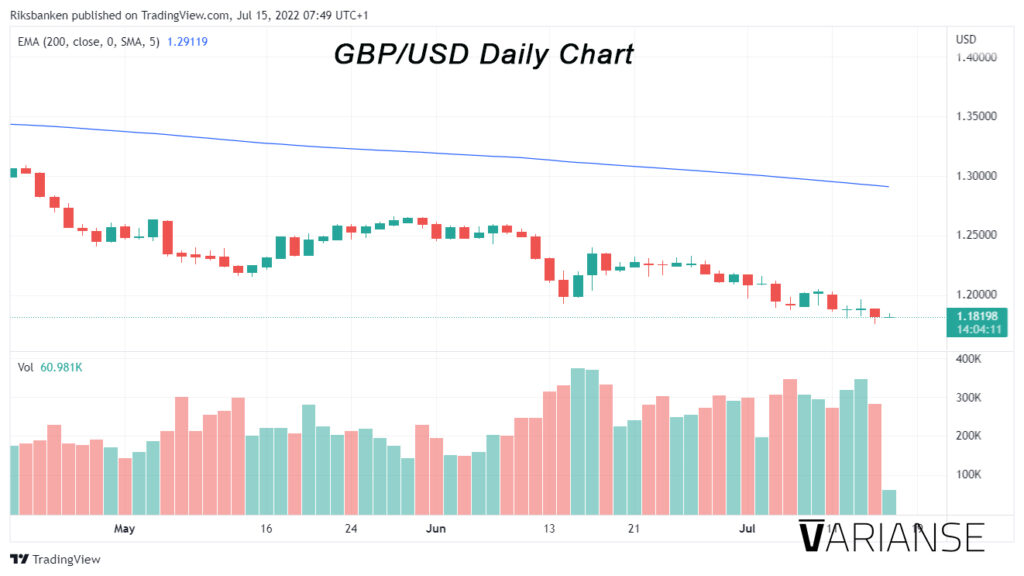

Downtrend Intact

A little over a week ago, when GBP/USD was trading at 1.1895, we suggested picking the bottom for GBP/USD was risky business. Since then the pair established a new low of 1.17603 on 14 June, before retracing some of its losses. Needless to say, the pair is still trading below its 200-day exponential moving average after this most recent look lower, a factor which always leaves me reluctant to be a buyer no matter the forex pair. Likewise, it seems to take some pretty heavy trading volumes just to abate some of the recent declines in price.

Intense Volumes

That said, there does seem to be more buyers jumping in when price does fall, just by the way high volumes under recent price declines don’t seem to provide the same level of price decline as they once did. Selling pressure may be finding a degree of exhaustion as price approaches the 1.16 psychological level, but it is still too early to tell. At the moment, there is no clear sign of total market capitulation yet or any clear sign of reversal. Next week’s economic data could certainly be the catalyst required to change the situation for better or worse.