EUR/USD flounders post Fed decision

- EUR/USD back under pressure in June

- Congestion between 1.0630 to 1.0480 could prove pivotal

Fed outpacing ECB

EUR/USD managed to make a gain in May, after four consecutive months of declines, but thus far June has proven to be a bad month in terms of performance. After opening at 1.07322, the pair hit a low of 1.03593, to recently trade near 1.0452. Most recently, EUR/USD has come under pressure as the Fed seeks to tightened monetary policy more aggressively, significantly outpacing similar efforts outlined by the ECB. Fears of global recession and ongoing geopolitical concerns related to the war in the Ukraine have also played unfavourably for the euro.

Technicals reflect fundamentals

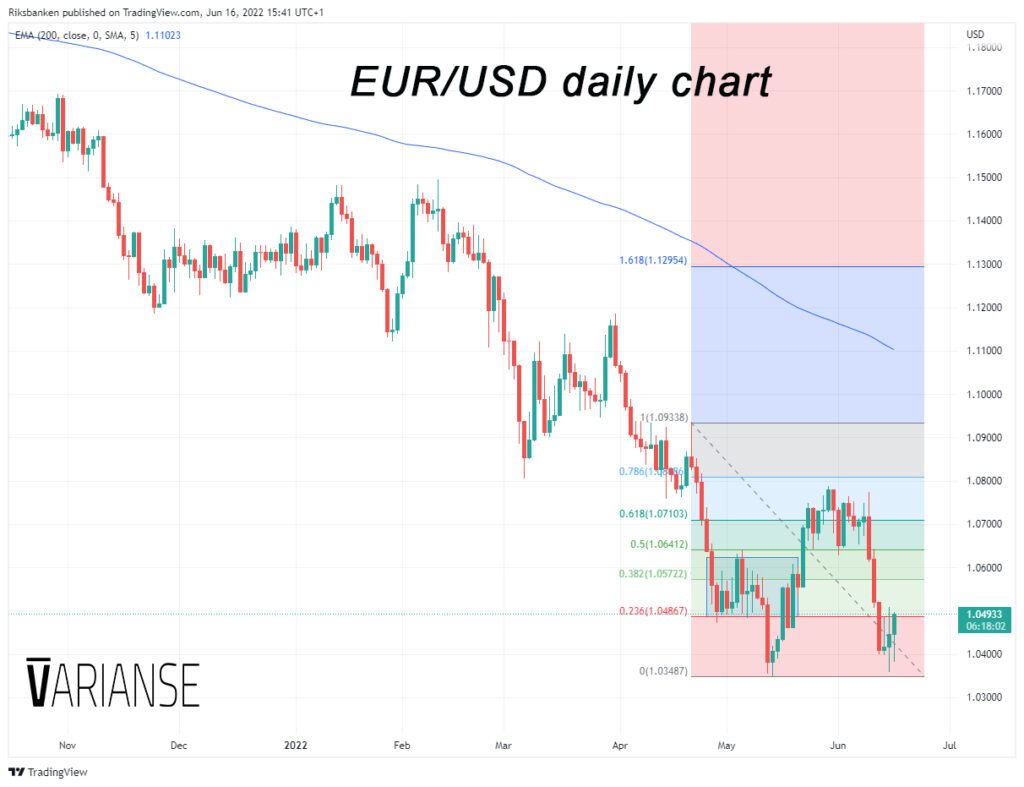

The technical setup very much mirrors the fundamentals. EUR/USD is trading well below the 200-day exponential moving average both on 4-hour, daily, and weekly time frame. This makes placing long positions risky business for the average trader. The May 30th swing high of 1.07870 failed to produce a subsequent series of higher lows and higher highs necessary to convince traders of a big change in prospects for the single currency. Moreover, the prior congestion zone between 1.0620 to 1.0480, has proven to be more an area of resistance than support.

Keep an eye on Fibonacci levels

Whether you are a buyer or a seller, keep your eyes peeled for a successful break and retest or outright rejection of the 1.055 region. From there, the next real test will be 1.06412 level, which represents the 50% Fibonaccian retracement level between the 21 April swing high and 13 May swing low. A break above this level may restore confidence of a shift in trend to the upside.

Meanwhile, were price to slip below the 12 May low of 1.03487, the Jan 2017 low 1.03402 could act as support, before reaching 1.02712, and the 1.01304 level. Near parity remains a key psychological support level, which if broken could see market capitulation, but the market is not there yet.