Managed Forex Accounts: The Top Solutions

- Becoming an asset manager is an excellent way to make extra money

- Navigating managed forex accounts solutions can be difficult

- cTrader Copy is definitely the superior choice

Earn as You Trade

If you are a profitable trader, but short on capital and want to enhance your returns, then opening your own forex fund is the way to go. It is certainly an alternative to trading challenges, where you pay an entry fee, the return hurdles are excessive, and the probability of winning is low. Save your hard earned money by setting up your own forex fund with the proceeds and leverage investor money. To do so, however, will inevitably lead you to look for some sort of managed forex account solution. Below is a breakdown of the most commonly used managed forex accounts types ranked by their functionality and ease of use.

What Are Managed Forex Accounts?

Before diving into the various managed forex account options out there, it’s worth pointing out what exactly managed forex accounts are and why they are so popular. Managed forex accounts, and managed accounts more generally, have been around awhile. My earliest memory of managed accounts harks back to my days at Merrill Lynch in New York, where very high net worth clients were putting their investments in managed accounts under the direction of some of the biggest asset manager names of the day. Back then, as it is today, the investment minimums for such a service were in the millions of dollars. So, these types of products are definitely not toys.

Funds Stay With the Investor

Unlike many other types of asset management arrangements, where clients hand over the money in the custody of the asset manager, a managed account means that client funds and investments never leave the client’s account. Instead, the manager trades the client’s brokerage account on their behalf using a limited power of attorney. This way, execution and custody of funds stay with the clients designated broker. In turn, the asset manager usually makes money by collecting some sort of asset management fees for the assets under management. In the case of forex, the payout methods for the asset manager or trader vary widely depending on the setup. Meanwhile, the brokerage house profits from the client’s related trading activity.

Hugely Popular

For traders looking to attract investors and raise capital, managed forex accounts make an excellent starting point because they don’t need to deal with the heavy infrastructure requirements that go alongside handling client funds. Everything happens in the client’s account. This is the exact reason why the managed account approach has exploded in popularity in terms of forex traders looking to get into 'some form' of asset management. Inevitably, that has led to brokers adopting a number of different solutions. Many software providers provide different solutions for brokers that plug-in to the MT4 platform. As a result, the way one type of managed forex account setup works at one broker won’t be the same as another broker. Nor will the information provided to the trader or asset manager.

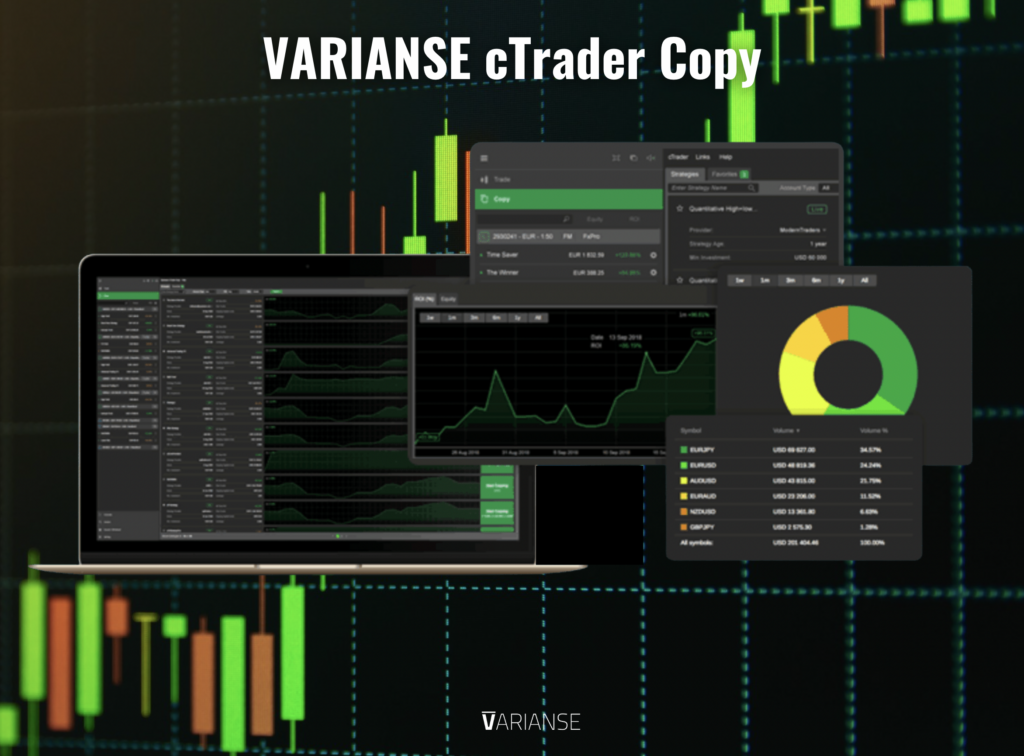

#1 cTrader Copy

cTrader Copy takes the top spot in terms of the best end to end managed forex accounts solution by incorporating the best attributes of the other systems available. Just like other managed forex account types, funds never leave the individual investors brokerage account. By being integrated into the popular cTrader platform created by Spotware, however, traders don’t need additional software solutions to get up and running. At the same time, they still benefit from a world class, algo friendly, platform that eclipses anything MT4/MT5 or most other proprietary broker platforms have to offer.

The cTrader copy trade platform also offers the most seamless managed forex accounts solution I’ve ever come across. All you need to do is open a broker account and set up your live strategy account and investors can start copying your trades in 1 click. cTrader takes care of the rest. Here are some of the key features that really impress me about cTrader Copy:

- Automatic equity to equity ratio copying

- Independently verified performance (no need for external software)

- Full stats on investors and trading performance

- Embedded URL links to showcase your strategy, automatically generated to invite your investors

- Multiple fee options: management, performance, and volume calculated and paid automatically

- Investors can close their positions and stop trading at any time

- Investors can set their acceptable level of loss in real money terms

The bottom line is if you want a scalable service that just gives you a completely and integrated out of the box solution to get started, then cTrader Copy is the right choice. Moreover, cTrader copy gives one big additional benefit over other solutions. Traders who set up their fund management business have access to nearly 2 million potential investors with over $2 billion capital, all sourced from the clients of brokers who use the cTrader platform.

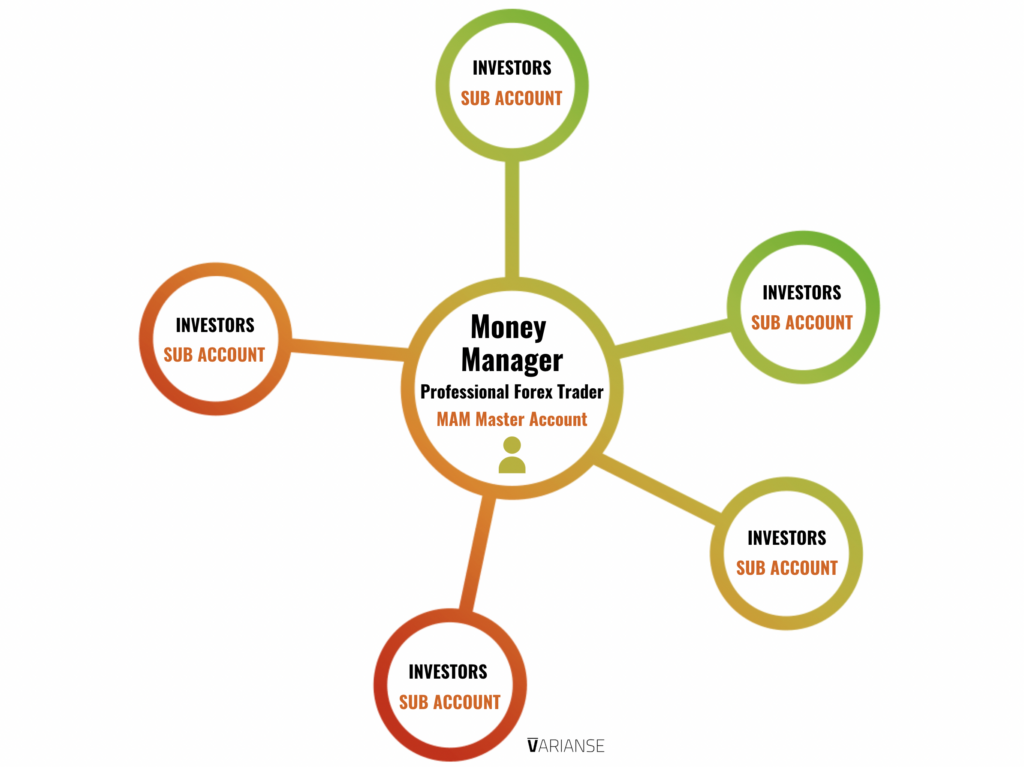

#2 Multi-Account Manager Module (MAM)

The MAM is arguably the most flexible of the managed forex accounts setups available today. A trader or asset manager is given control over each individual investor’s brokerage account. Profit, loss and fees are distributed on an individual account basis so traders, just like with cTrader Copy trade can withdraw their funds at any given time without any extra aggravation for the manager.

While all this optionality may sound attractive, unlike cTrader Copy, managing so many different accounts using third party software on top of multiple MT4/MT5 platforms can prove a real headache. Advanced knowledge on the MT4/MT5 inner workings is also required. In addition, it leaves open room for potential allocation issues as the onboarding of individual clients requires some degree of manual process on behalf of both the manager and the participating broker. Furthermore, investors can also trade on their own account, adding additional complications in terms of attributing performance. Worse still, there are so many software options when it comes to MAM setups, terms will different widely depending on the chosen broker.

#3 Risk Allocation Management Model (RAMM)

The RAMM system is very much like a MAM approach, but offers investors more optionality. For example, investors can set limits to their losses, and also set take profit levels in order to exit their trades. Unlike the MAM and LAMM (discussed below) systems, however, investors can’t just open and close trades in their account, which simplifies the management requirements quite a bit in terms of fee collection. Certain software versions of RAMM also provide the ability for investors to pause their participation in the manager and allow for multiple broker access and decide what ratio of investment in each manager’s trades.

Again, while all that sounds very attractive, the RAMM solution still suffers from two fatal flaws: it relies on additional third-party software to function and typically only works with MT4/MT5 platforms. With so many providers out there, very little is standardised when it comes to offering, making adjusting from one broker to another incredibly difficult. In addition, it lacks the ease of onboarding offered by cTrader Copy.

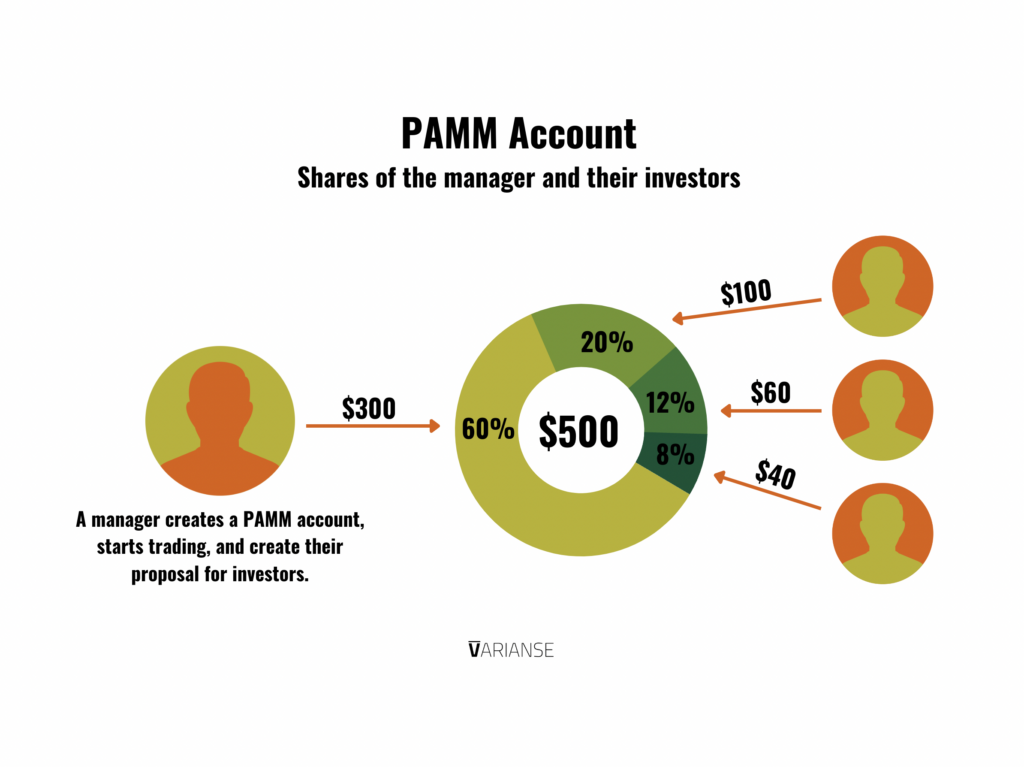

#4 Percentage Allocation Management Module (PAMM)

PAMM is arguably the most complex managed forex accounts system. Unlike the rest of the solutions outlined. PAMM type systems, in their truest form, require clients' funds to be pooled into a single account or at least attributed as a single share, which is then managed by the single asset manager trader. As such, withdrawals become a more complex process as they are based on a fixed pool of investment. The underlying PAMM software then allocates profits and fees on a set ratio basis. So if a client has invested $100,000, and that represents 20% of the total funds in the PAMM, the client is allocated 20% of the respective profits. Unlike cTrader copy, setting up a PAMM requires external software for just about every function. In addition, in terms of forex fund arrangements, the setup is usually associated with the MT4/MT5 trading platform.

Sounds simple enough, but in reality the situation can get messy. Rollover periods, when the manager calculates their fees, can be affected by big withdrawals at that period. Moreover, because there are many types of PAMM software setups, just take a look at this list, standardisation is again lacking. So, although the setup can be good, the terms are not always uniform. For example, in certain PAMM setups new investors cannot be immediately join the fund and exiting investors cannot leave. Also the type of fees available to charge to investors varies widely. Withdrawal, profit on equity, profit on returns, management fees etc may or may not be available. Also, the learning curve behind the system can be high as a piece of software that sits on top of MT4.

#5 Lot Allocation Management Module (LAMM)

I’ve added LAMM to the list for completeness. LAMM is one of the first types of managed forex account types to come on the scene. Instead of using portional equity or a fixed fixed share of initial capital, LAMM matches the trade size of an investor’s account with that of the manager. By doing so, it really constrains how many investors can follow a particular fund because they must match lot sizes. Thus a lot of LAMM accounts have traditionally high minimum investment requirements to really be successful. More recently, a lot of LAMM systems out there have moved away from pure lot matching to proportional matching based on a predetermined ratio.

Even so, LAMM systems are also plagued by lack of standardisation across products. Likewise, most aspiring asset managers these days typically opt for managed forex accounts systems that provide more flexibility than the basic LAMM. More times than not, active LAMMs represent older funds that are using more legacy software solutions technologies.

Go With cTrader Copy

The world of managed forex account solutions can be daunting. Behind the silly acronyms, the number of services providers and the lack of standardisation across services makes selecting the right solution difficult. That’s exactly why I recommend cTrader Copy, which has all the built in functionality to set up an asset management business already built into the platform even though we do offer the various other types of systems.

cTrader Copy takes the best aspects of other systems and combines them with an incredible modern, friendly, and highly professional user interface, which really puts MT4/MT5 to shame. Attracting investors, especially in the 2020s, where investor platforms have become super sleek, requires instilling confidence. cTrader Copy does exactly that, while also giving traders an amazing platform to trade. Just be aware that the regulations associated with managing other peoples money vary depending on jurisdiction.