What is Straight-Through Processing in Forex?

- Straight-through processing doesn't mean much on its own

- Market access and trading counterparty matter more

A Confusing Term

According to Wikipedia, straight-through processing, sometimes abbreviated STP, is a method used by financial companies to speed up financial transactions by processing them without manual intervention. That’s an accurate assessment, but not all that helpful in the context of usage of the term in the context of online trading. In fairness, Investopedia does a modestly better job in terms of providing a bit more background on the subject. Nevertheless, a lot of the associated material on the internet focuses on straight-through processing as it pertains to payments, cash equity trading, and to a certain extent crypto currencies.

Straight Through Processing for CFDs

That’s helpful, but what about in the context of forex and CFD trading, where a large part of online trading activity takes place? Well, straight-through processing has over time become a bit of a marketing term in the world of online trading providers. In turn, that has led to an extreme amount of confusion amongst new and experienced traders alike in terms of meaning. Wouldn’t all online forex and CFD trading platforms rely on automatic processing of trades if they are trading online? Indeed they do, so it’s easy for a lot of brokers to use the term loosely.

ECN vs Market Making

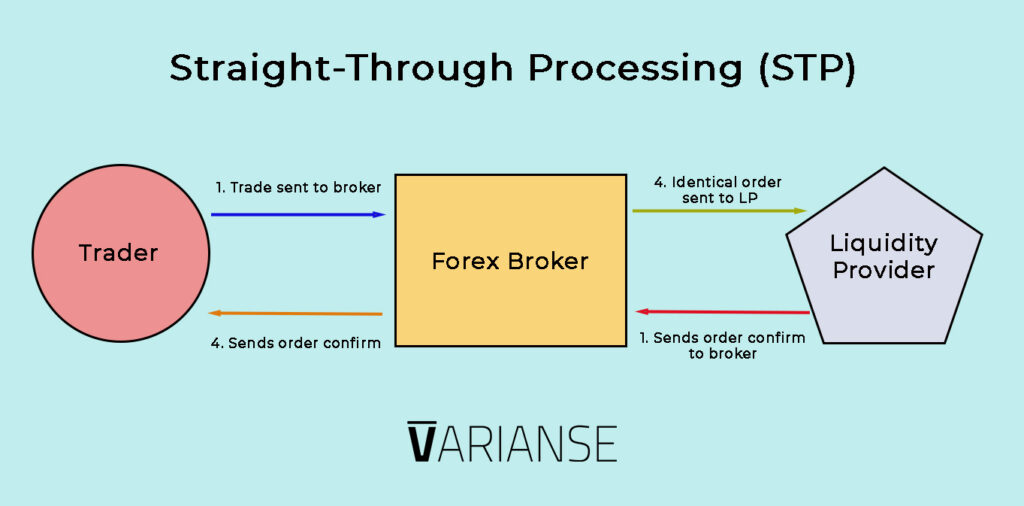

Meanwhile, online traders have over time come to associate the term with either direct market access (DMA) or electronic communication network (ECN) type access. When an online trader hears the term straight-through processing, they tend to think that a broker is automatically passing their trades on to the relevant market directly. In reality, however, that may not be the case. Many brokers and service providers out there are what are called market makers. Market makers show you buy and sell prices and then take the other side of the transitions.

Mixed Up Models

Others run a mixed business model, where they pass some trades on or in certain other cases take the other side of your trade. Whether a brokerage firm is a full or partial market maker, doesn’t stop them from claiming they offer straight-through processing. They just offer straight through processing to themselves as the ultimate counterparty either 100% of the time or irregularly. By the way, there is nothing necessarily wrong with this type of activity. The main point here is straight-through processing and ECN or DMA access are two mutually exclusive terms.

Applies Universally

By the way, direct market access and ECN isn’t just a concept confined to forex or CFD trading. They, alongside with straight-through processing, apply to traditional stock broker and other financial services providers. For example, the London Stock Exchange (LSE) makes clear that when you execute a trade through your broker that it rarely happens directly on London Stock Exchange order books. Instead, stock brokers have traditionally requested prices from specialist market makers, known as Retail Service Providers (RSPs).

So, straight-through processing happens, just with a select group of market makers rather than the market itself. Only a handful of service providers offer Direct Market Access (DMA), which allows investors to place your orders directly on the LSE order books.

Final Thoughts

The bottom line is that straight-through processing is ubiquitous in the 21st century. Manual intervention in financial services is more the exception rather than the rule today. Most people have come to associate the term with DMA or ECN type order pass through, but they completely separate meanings. Broker and counterparty make the big difference in terms of one's online forex and CFD trading conditions, so you should always do your homework in terms of which company you select.

Thankfully, VARIANSE, takes all of the hard working trying to find a broker away. As a purely execution only ECN broker, VARIANSE gives you direct straight-through processing to deep liquidity pools. Let Experience our SMART order routing and pricing engine for superior execution during high volume trading. Find out why clients in 100+ countries choose VARIANSE as their online broker,