cTrader Crypto Trading: The Best Bits

- cTrader crypto trading has simplified my trading life

- Trading cryptos on the cTrader platform offers serious advantages

- VARIANSE zero-spread CFDs offer trading conditions on par with exchanges

cTrader Crypto Is Game Changing

Having been given early access to the VARIANSE zero spread-crypto CFDs has given me more than a couple of months to try out crypto trading on the cTrader platform. I won’t lie that I was skeptical at first about cTrader crypto trading. After years of trading on the big crypto exchange platforms and on peer-to-peer exchanges, I had gotten used to a very split trading lifestyle: separate platforms for crypto and another for everything else. Sure, bridges between crypto platforms and other more traditional third-party retail trading platforms do exist, but in my experience, the majority have always proven to be more than a bit clunky. Today, as I near my three month cTrader crypto anniversary, I couldn't imagine another way to trade cryptos. Below are the top three reasons I am sticking with cTrader crypto trading going forward.

cTrader Crypto Is Just So Easy

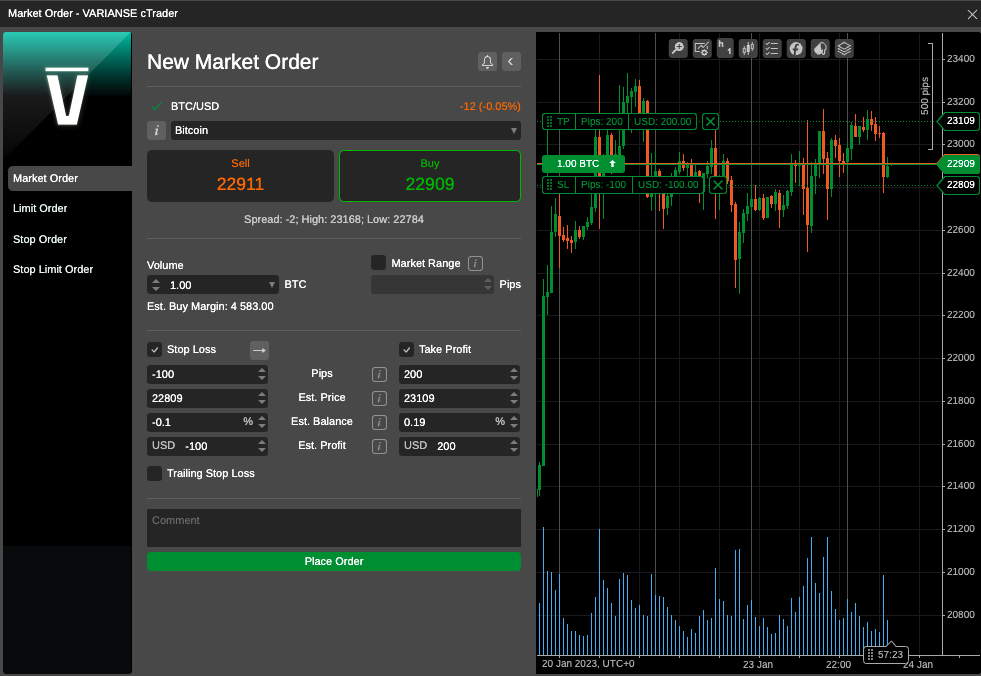

cTrader crypto trading with CFDs is just way easier. The platform calculates everything a trader needs to know before they execute a market or pending order. In cTrader, a one lot crypto CFD contact is simply one coin. A trader can go as low as a micro lot or 0.01 or 1/100th of a coin. That literally is all a trader needs to know. From there, everything else is calculated by cTrader: the estimated margin used, the estimated % of the traders balance at risk, the estimated take profit, if the trader sets a take profit level. Traders that are more conscious about can even position size based on the % of their balance at risk.

Everything in One Place

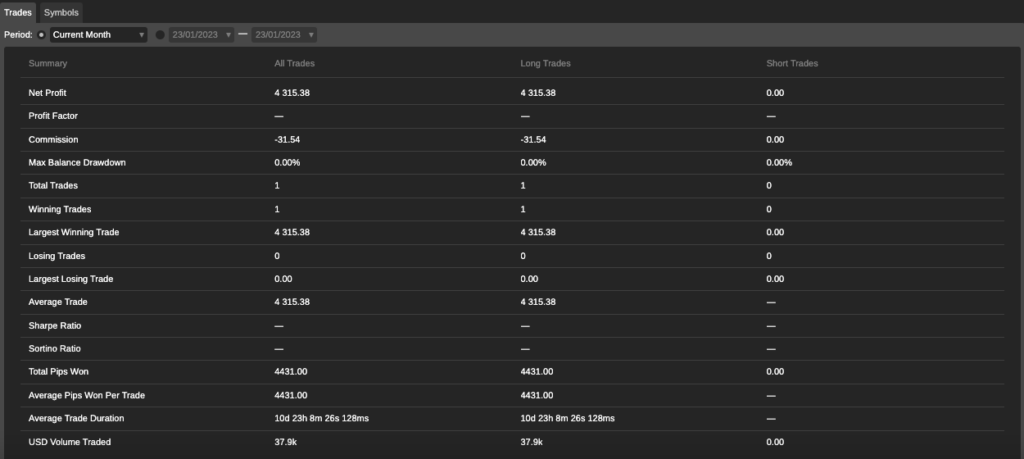

I really can’t overstate the benefits of being able to trade all of the asset classes in one place. These benefits stretch far beyond just simple convenience, which is an obvious blessing. While different asset classes may require different strategies at any given point, risk management and performance principles are universal. cTrader crypto trading allows traders to manage their aggregated trading risk, alerts, and performance across crypto, forex, equities, commodities, indices, and equities, all on a single platform. Better yet, the cTrader Analyse function does a lot of high level heavy lifting for traders in terms of performance. No add-on or third-party software is required. This feature alone makes the switch to cTrader worthwhile.

Advanced Functionality

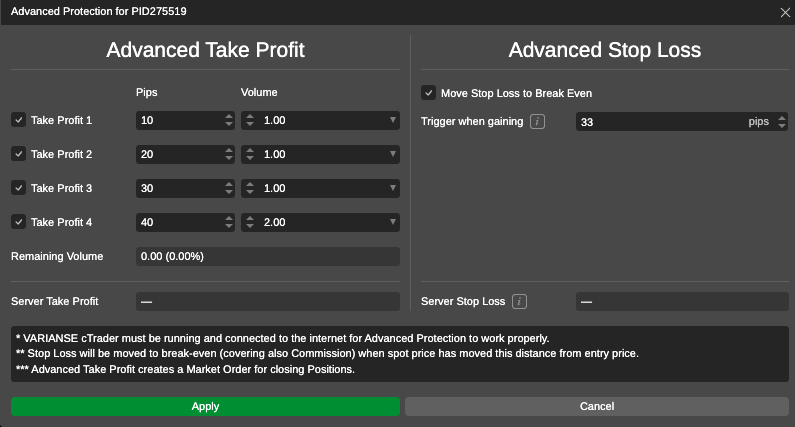

The cTrader platform already comes equipped with some pretty advanced functionality in terms of charting, news, indicators etc. My favourite feature, however, is the advanced order protection functions provided on the platform. Typically, this level of order protection requires a degree of programming, which comes at an expense. With cTrader crypto trading, I can actually set take multiple take profit levels on my crypto trades, scaling out of my winning trades safely and securely, whilst adjusting to breakeven automatically from the platform. In a market as volatile as crypto currencies, protecting my profitable trades ranks as one of the number on concerns for me day to day. To date, I've not come across another platform that does this as well as cTrader.

Compatibility

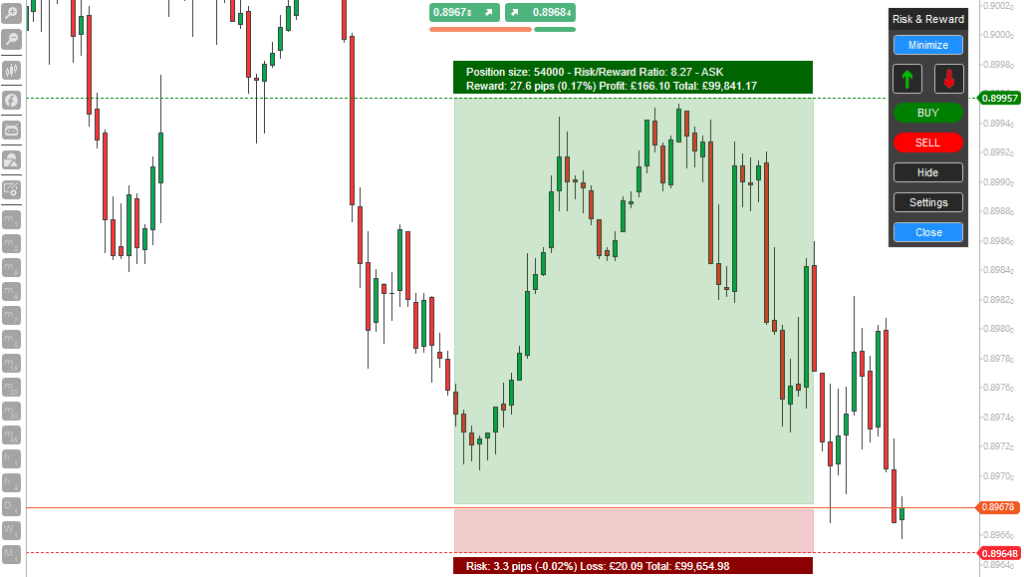

The available built-in indicators and functions in cTrader are great. Even better, however, is the ability for traders to use their existing custom indicators, algos and automations with crypto. The need for multiple platform development is absolutely gone. For example, I am able to use my volume profile indicators and risk reward tools developed by ClickAlgo seamlessly between cryptos as I do gold or forex. In truth, given the maturity of CFD platforms like cTrader, there are a ton more of well established automated solutions available in comparison to other crypto platforms. Above all, traders are getting the benefit of development using the C# language, which leaves their automations faster, more reliable, and far more capable then some of the more retail platforms out there.

cTrader Copy

Short of crypto, or trade ideas more generally, traders can use the cTrader copy feature to follow other traders strategies. Meanwhile, traders with strong convictions, can invite other traders to copy their strategies in exchange for management, performance, and volume fees without the need to ever leave the platform.

Final Thoughts

Above is just the tip of the iceberg in terms of what cTrader crypto trading has on offer in relation to other trading platforms. But cTrader crypto trading is only worthwhile when traders partner with the right broker. The VARIANSE cTrader crypto offering was purposely designed to offer zero spread and low commission crypto CFD trading on par with what is on offer from the major crypto exchanges. In a prior blog post, I wrote quite a lot about the advantages of trading crypto CFDs using a regulated STP broker like VARIANSE versus unregulated exchanges. Those advantages extend just beyond platform features. Open a newly funded VARIANSE crypto account today and enjoy a 10% deposit bonus and find out why VARIANSE is the #1 broker for trade execution.