Trading Volume Requires the Right Broker

- Volume analysis is a powerful trading tool

- Not all online brokers provide quality trading volume data

Trading Volume is Overlooked

Trading volume receives less airtime on the internet relative to price action, candlesticks, chart patterns, technical indicators, or even pure fundamentals. That’s unfortunate because using trading volume analysis is one of the few tools that truly complements any trading style. Those who incorporate volume analysis into their everyday forex trading enhance their ability to distinguish between profitable and non-profitable trading opportunities. To use volume analysis successfully, however, really requires the right broker with the right data.

Finding Trading Volume

Many forex traders don’t embrace volume analysis due misperceived imperfections in forex trading volume data. Forex, unlike many other markets, due to its size and diverse set of participants, truly has no single centralized exchange. As a result, no precise real-time reference for forex volumes exists. Traditional sources for forex volume data, such as the Bank of International Settlements Triennial Survey of Foreign Exchange, try to capture volume data, but only infrequently and only for a single snapshot in time. More timely accurate numbers that are accessible to online traders are truly scarce.

Certain online brokers settle on providing publicly available forex futures data in lieu of having the true underlying volume data. Exchange-traded forex derivatives, such as futures, do provide reasonably accurate volume data for their respective products, but they only account for c. 2% of the foreign exchange market. Lower time frame analysis using futures data proves to be another challenge, due to the lack of accurate timely data available from exchanges. In short, futures volume doesn’t always fit the bill.

Tick Data Is the Best Proxy

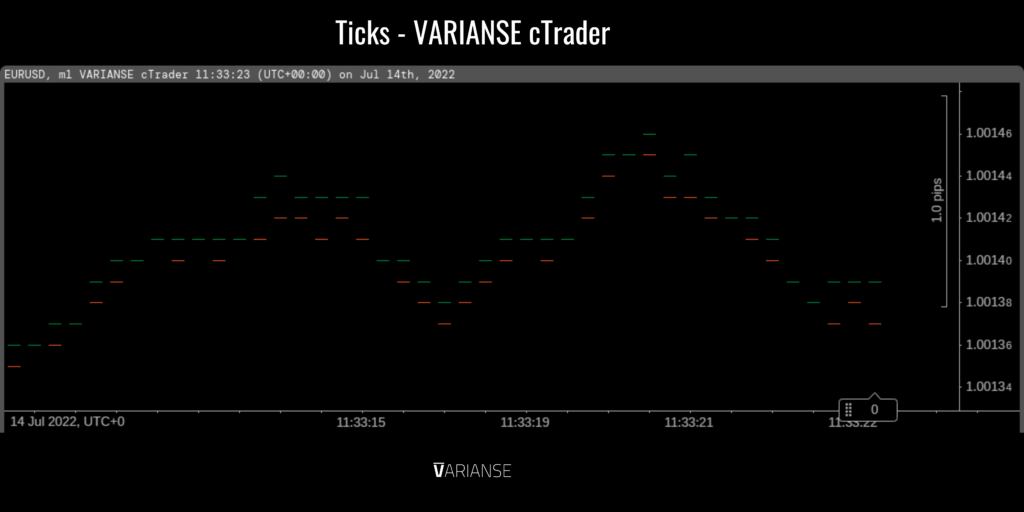

Thankfully there is another solution. It turns out that tick data is an excellent proxy for actual traded forex volumes. For those unfamiliar, tick data is just a count of how many times price changes over a given period. Casper Marney, a forex veteran, who worked at HSBC and UBS as a trader, published an in-depth report in 2011 on the high degree of correlation between tick and real forex volume data. According to his research, 90% of tick volume corresponds to actual aggregated forex volume on the world’s largest spot forex electronic communication networks (ECNs). Other more anecdotal evidence also points to a similar conclusion.

Tick data’s strength as a proxy for volume is why most brokers use it as a measure of volume to display on their platforms. Yet traders should be aware that tick data quality amongst online brokers varies substantially. In particular, be on the lookout for market making brokers, who invariably by the way they operate, may not be showing the full depth of price changes in the forex market over a given time period. Odds are their feeds lack the granularity to use trading volume effectively.

ECN Broker Granularity

ECN brokers, on the other hand, provide access to a multitude of liquidity providers, thereby giving traders access to the most granular tick data available. In other words, the more true ticks that filter through to a traders platform the better. It is no coincidence that Casper Marney used ECN networks to conduct his study. Hence traders looking to make a proper start at using volume analysis, in whatever form, should do their homework in terms of the broker they choose. With real money at risk, traders shouldn’t risk losing their edge, no matter how small, due to poor data quality.

The VARIANSE cTrader platform, which gives traders true ECN access to tier-1 bank and specialized high frequency liquidity providers gives the best shot for traders to get trading volume analysis right from day one.