USD/CAD Above 1.30 Ahead of BoC

- The BoC is expected to hike by 75 bps on Wednesday

- How much more can the BoC do after September is the big question

USD/CAD Trying to Push Higher

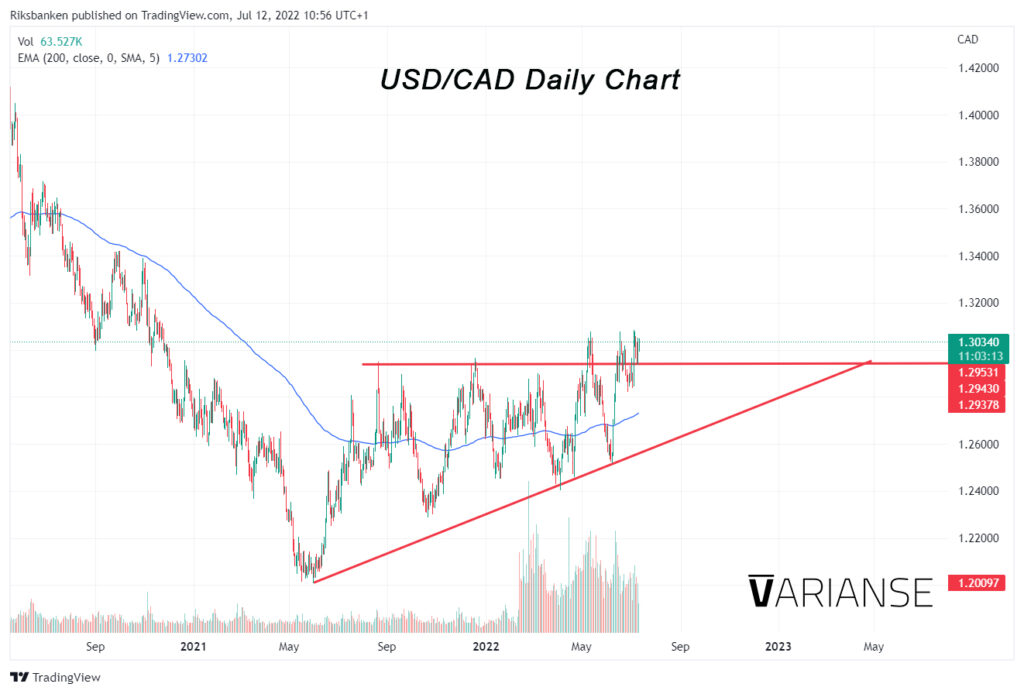

With forex traders squarely focused on the collapse of the EUR and GBP, USD/CAD may not be getting much airtime at the moment. Nevertheless, price at the time of writing was again pushing up above 1.30, after two failed attempts to stick above that level in May and June of this year. Prior attempts to break above the 1.2937 to 1.2943 resistance area failed on the retest, but this latest thrust higher has found some support above that region. For me, 1.30 remains a key level to watch as it marks the September 2020 swing of the prior downtrend. The ascending triangle pattern that fully formed in May is also hard to miss.

BoC Expected to Hike by 75 bps

Of course, one chart pattern or support/resistance level doesn’t make a trade. Crude oil price gyrations are also certainly having an impact on USD/CAD at the moment. Given that the Bank of Canada is also widely expected on Wednesday to raise its key interest rate to 75 bps to 2.25%, being bearish CAD at the moment might seem misplaced. Like the Fed, the Bank of Canada has been talking tough on inflation. Economists are expecting another 50 bps hike in September, according to a recent Reuters poll. Thereafter, however, there is mixed agreement on the future degree of tightening.

Canadian Housing Market Concern

One big area of concern is the Canadian housing market, which is already feeling the heat from higher interest rates. Home resales in May were down by 8.6% from April - the third consecutive drop. After falling 1.1% in April, Canada’s national MLS Home Price index declined by another 0.8% in May. Most believe the recent cooling in Canada’s housing market won’t deter the Bank of Canada from hiking interest rates. But the big question for traders, and ultimately for USD/CAD, should be what more can the Bank of Canada signal on Wednesday in terms of interest rates hikes given its current constraints.