How to Find Forex Trade Ideas Like a Pro

- Generating trade ideas requires a systematic approach.

- Prioritising the forex pair you cover is paramount.

Trade Ideas Don't Grow on Trees

Good trade ideas don’t grow on trees. Traders need to do their analysis. But in a 24-hour market, with so many forex pairs, even the most well intentioned trader can feel overwhelmed. No one has 18+ hours a day to spare for forex analysis. If you want to trade forex, you need a framework that allows you to work efficiently. After 10+ years trading and advising on financial markets, I've picked up certain tips that will help you generate the best trade ideas.

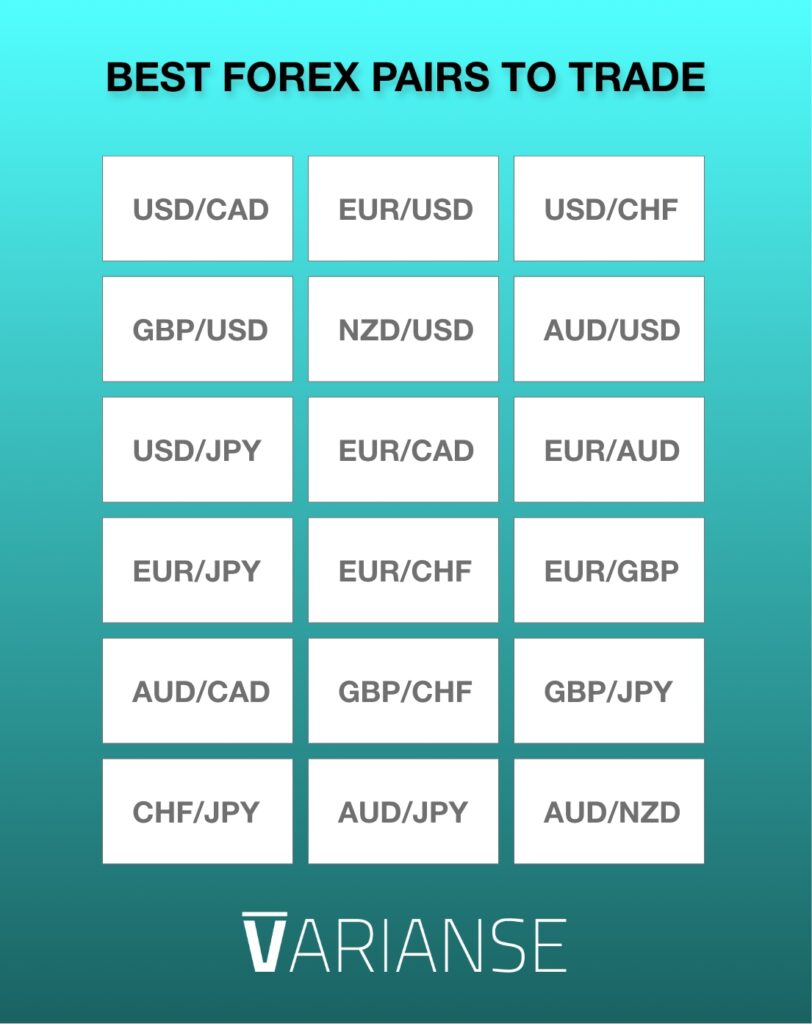

#1 Don’t Try to Cover Everything

The world has over 180 currencies, according to the United Nations. That translates into 16,110 potential pairs. Covering them all would be impossible. Thankfully, only 18 of them have the right trading conditions to be consistently profitably. You don't need to start covering all 18 at once. Over time, however, you will at least want to diversify your trading to cover non-US dollar pairs. This will help you avoid taking on too much USD dollar risk. A bigger coverage set will also give you a better feel for the broader themes in the currency market.

#2 Create Your Own Template

Before you start, you first need to create a uniform template for each forex pair you intend to cover. You will use this to keep track of potential trade ideas. Personally, I use Google Docs to create the template, because it’s free and I can access and share my documents easily with others. I’ve got an Android phone and a Mac laptop, and Google Docs allows me to edit my documents on my mobile with ease across platforms. Programs like Microsoft Word or Apple Pages, however, will work just the same.

Regardless of the word processor application, a set template guarantees consistency of approach. Everyone’s approach to markets is different, so how their template is constructed will differ. Just as long as they they are consistent across the forex pairs, everything is fine. For example, my trading approach is a hybrid mix of fundamental analysis and price action. Therefore, the sections I write to are:

- The fundamental narrative

- Weekly price action analysis

- 1-day price action analysis

- Possible Setups

- Priority Rating

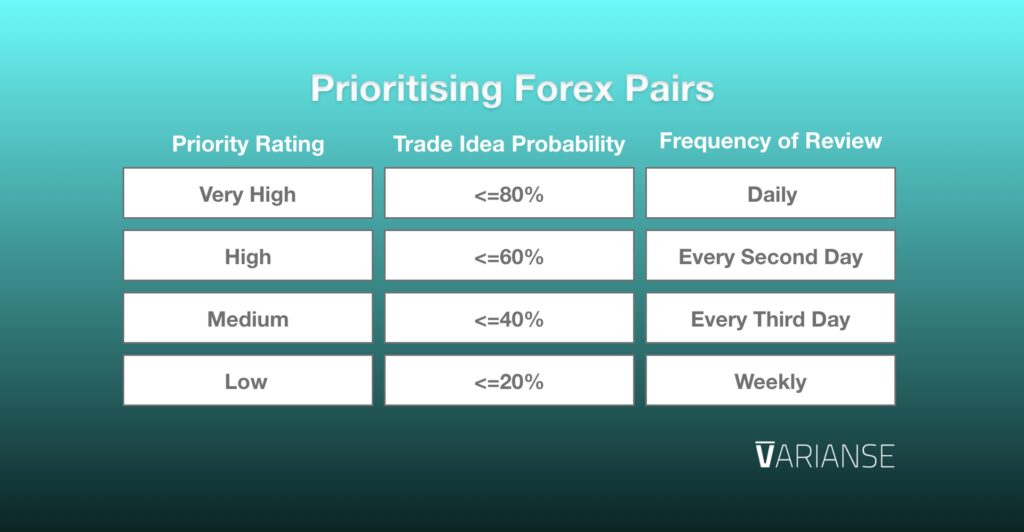

No matter how much you personalise your template, the most important part is that you include a "priority rating" based on how close a forex pair looks to becoming a valid trading idea. I use a 4 point scale between "very high" and "low". "Very high" has the highest likelihood that a pair is close to throwing off a trade idea and "low" represents the absolute lowest. Your criteria and frequency of review will depend on your style of trading.

#3 Set Up Folders Based On Rating

Once you’ve designed your analysis template and done your initial analysis, set up a folder for each individual rating. Afterwards, save the analysis for each forex pair in its respective rating folder. Higher rated pairs should be revisited on more frequent basis versus those of a lower rating. Exactly what frequency you revisit each category, just like the criteria you use to categorise, greatly depends on your individual trading style.

I revisit the “very high” category daily, the “high” category every second day, and the “medium” category every third day, and the “low” category once a week. Based on my criteria, I either change the category for the forex pair higher, lower, or leave it unchanged. Frameworks like this have several advantages:

- Allow you to easily compare the "very high" trade idea categories to better gauge relative risk-reward and position sizing if you do decide to trade

- Mean you spend your time more efficiently on currency pairs that will offer higher probability

- Open up the possibility of trading more than just a handful of currency pairs

- Adapt to various trading styles and systems

#4 Don’t Stop After Opening a Trade

One of the oddest behaviours I’ve witnessed is traders who tend to stop analysing the forex pair after they've opened a trade. Many just go on autopilot with a take profit and stop loss. Committing money to a trade should give you more incentive to analyse not less. Open trades should take priority over closed trades in terms of coverage.

#5 Use Alerts to Keep You Informed

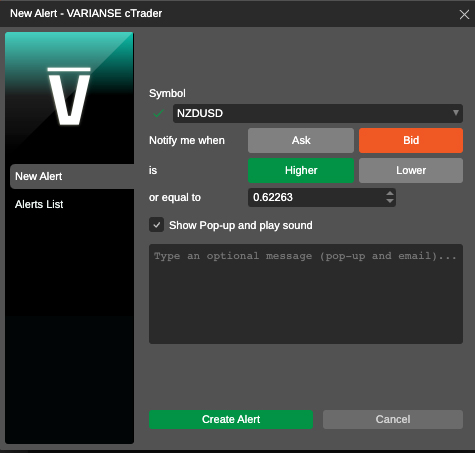

Price alerts don’t necessarily need to be used as a signal to trade. You can use price alerts to tell you when a forex pair analysis should be reviewed under the framework. For example, maybe a big data release or central bank policy has pushed a forex pair to a level where it warrants a shift from “low” to “high” in terms of priority. Another example would be if price, as anticipated, begins to form a symmetrical triangle pattern. Alerts allow you to make important off-scheduled updates to your analysis. Every time you review a forex pair for trade ideas, you should set alerts at levels that would change your priority rating.

Most trading platforms, such as the VARIANSE cTrader platform, allow you to add notes to your price alerts. You should make full use of this feature. Don’t be afraid to set too many well explained alerts, but avoid those with poor or no explanation. Aim to mirror your explanation in each analysis document, so you are better equipped when it comes time to revisit a specific forex pair.

#6 Remember to Delete Old Alerts

Poorly organised alerts, however, will leave a trader only more confused than if they had none. Make sure you review all the alerts for a specific forex pair. Delete alerts that are no longer pertinent. Ensure to make adjustments to others as necessary. Time is precious. A bit of diligence with alerts will save you time when it counts. Without good alert practices, covering 18 currency pairs is going to be a whole lot harder.

Final Thoughts

Whether you find my framework to generate trade ideas enticing or not, finding a system that works for you is essential. We are all guilty of opening up our trading platform and just taking a punt on a random trade that may look like it has some potential. Gambling can be fun, just know that you are really gambling and position accordingly.

That said, in order to find consistent high probability forex trade ideas, you will have to do regular ongoing analysis across a number of forex pairs. Having a framework toward your analysis helps you implement your trading approach in an organised, efficient, and disciplined way.