The Dragonfly Doji: Strikingly Useless

- The dragonfly doji is rare and unreliable

- It has proven to be a poor bullish reversal signal

- The wider set of doji patterns are associated with indecision

Beware the Dragonfly Doji

Extremely rare and largely unprofitable, the dragonfly doji candlestick pattern doesn’t warrant the level of interest it receives online. Its popularity comes from its unique shape, which resembles the side profile of a dragonfly, combined with and a strong interest in Japanese candlestick patterns amongst traders. Still, the truth is certain Japanese candlestick patterns work better than others. The dragonfly doji, unfortunately, ranks as one of the least helpful. Below I've listed some of the key aspects about the dragonfly doji that all traders should know before losing money trading this pattern.

Truly Unique Circumstances

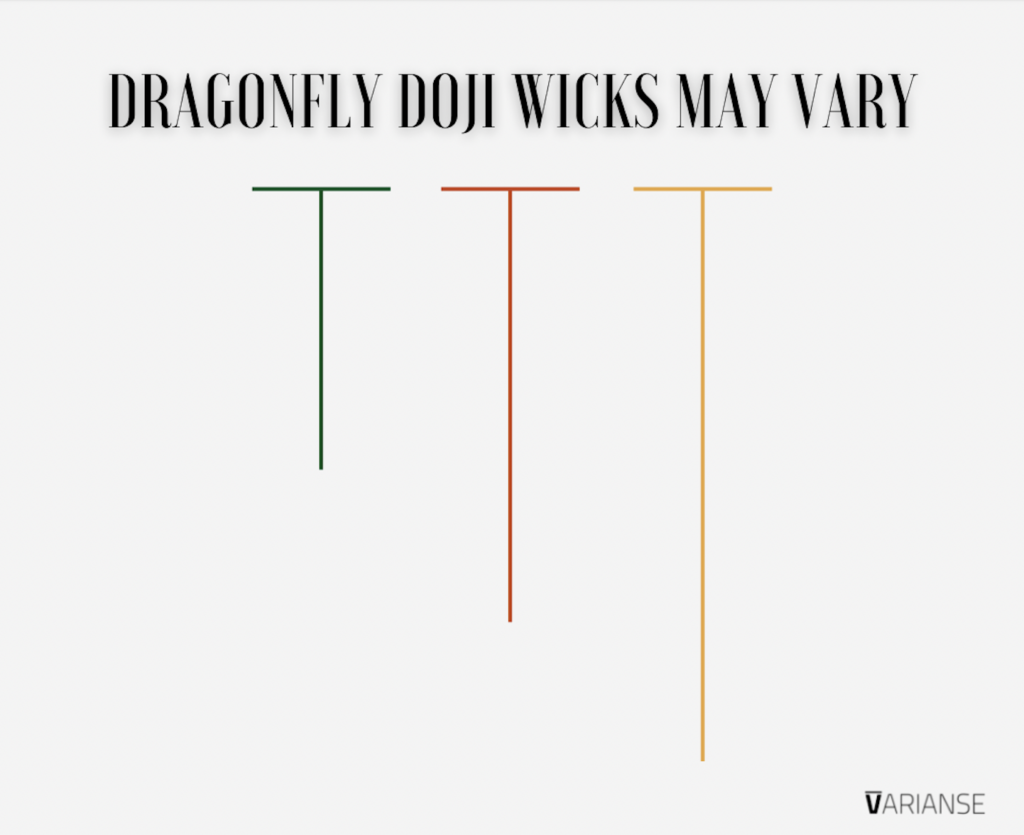

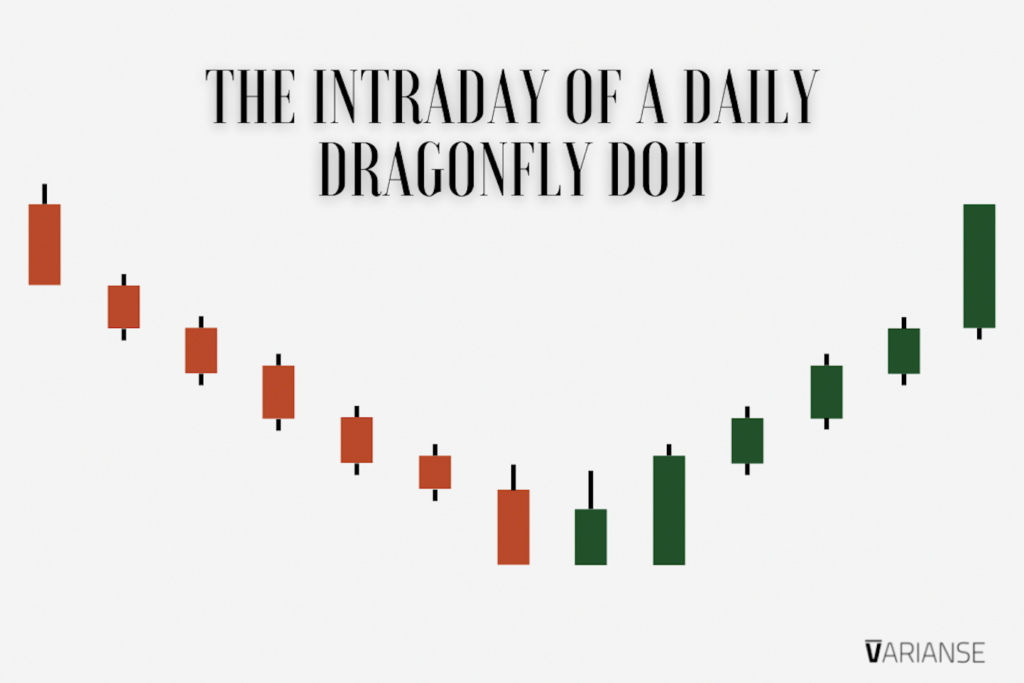

The dragonfly doji forms under a single circumstance: where price over a given timeframe dips lower prior to rising back to its open, which also acts as the high and the close. Such strict criteria inevitably makes the chances of a dragonfly doji forming extremely low. As a result, the rules have been widened to admit a candle with a body that is 5% of the total range as a dragonfly doji. Meanwhile, there is no length requirement for the bottom wick of a dragonfly doji. Most, however, associate the length of the lower wick with the degree of bullishness associated with the dragonfly doji.

Bullish Pattern?

Theory states that the dragonfly doji is a bullish pattern. That's because it represents a period when buyers were willing to absorb selling pressure, ultimately pushing the price back to its open toward the end of the timeframe. In turn, the positive price momentum at the close would seem to favour higher prices ahead. Typically, technical analysis textbooks highlight the dragonfly doji as a potential indicator that a downtrend is about to reverse. So, the context of the dragonfly in regards to the preceding price action is extremely important when trying to interpret any future price implications.

Confusing Linage

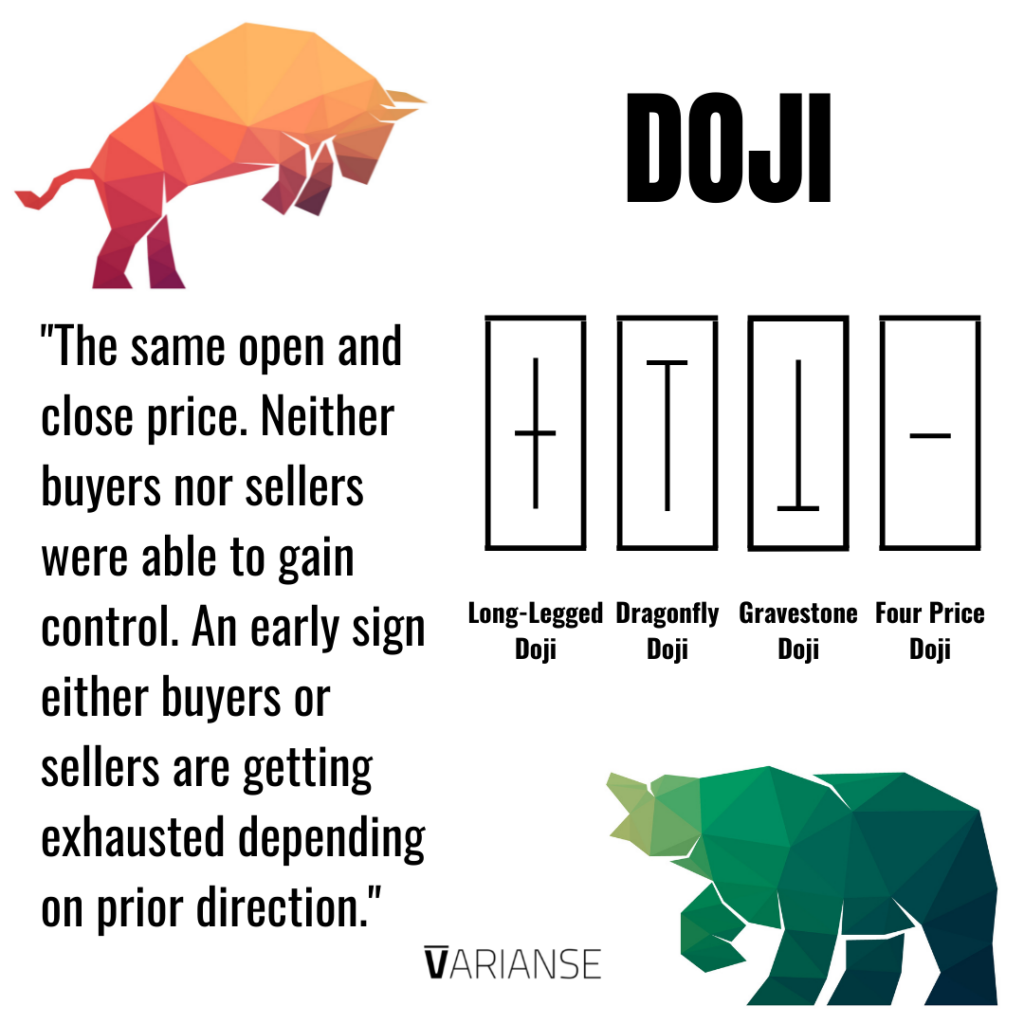

The dragonfly doji is part of a broader set of doji single candlestick patterns. The other members of the doji set include: the standard doji; long legged doji; the gravestone doji; and the 4-price doji. Each of doji may have their own specific meaning, but together they are commonly associated with market indecision more than outright reversal. Hence most traders, on the occasions where they do come across a dragonfly doji, don't solely rely on it alone as a buy signal. Instead they wait for confirmation from other sources.

Difficult to Find

Above all, dragonfly doji are pretty rare in forex markets, especially on higher time frames. For example, I have only spotted two dragonfly doji on the EUR/USD daily chart since 2003 and only one for GBP/USD. Lower time frames definitely provide greater frequency, but relative to other types of candlestick patterns, they just aren't that common. When they do appear, in many cases the context is wrong. This makes back testing the dragonfly doji's potential difficult .

Final Thoughts

Personally, if I see a dragonfly, it gives me pause for thought, but I don't rely on it to trade. Other traders I know will wait for a cleaner bullish pattern to form after a dragonfly, before placing a buy order, assuming the correct context. Some like to use volume spread analysis alongside their candlestick analysis before making a trading decisions. Whatever the circumstances, I don't know anyone who bases their trades purely on a single candlestick, let alone a dragonfly doji.

The VARIANSE cTrader platform provides you the most advanced features when it comes to candlestick charting and everything else technical. You have access to over 100 timeframes as granular as tick charts, standard, renko and range charts.